Dollar Not an Oversold Currency Waiting for Risk Collapse

Fundamental Forecast for US Dollar: Neutral

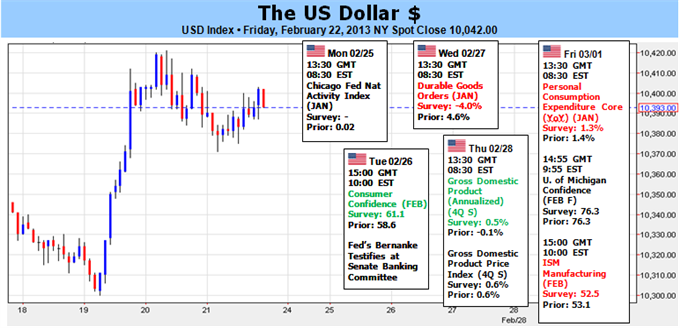

FOMC minutes panic market as officials discuss eventual stimulus exit

Consumer inflation keeps 2.5 percent threshold for hikes well in the future

Technicals suggest dollar may pullback before continuation as S&P 500 stalls

The US equity market’s have shaken otherwise complacent investors and further sown fear of what a serious risk aversion move could wrought for the financial markets. It would seem a clear read for the greenback should stimulus-backed confidence falter…but is it? In the currency market, the dollar plays a very elemental role as a refuge from panic and loss when the capital markets are stricken with instability. That function will not change through the foreseeable future. On the other hand, it takes essentially a systemic shock to drive us to the extreme where the greenback outperforms on all levels. Furthermore, the level of performance for the greenback may be skewed depending on what counterpart we compare it to given recent developments.

I am a firm believer that a meaningful correction / deleveraging of artificially-leveraged (through stimulus) speculative positions that lacks for yield and participation is inevitable. And, it is true that should market confidence waver, the dollar will quickly find itself undervalued as the market seeks out liquidity, stability and safety of funds. However, the degree to which the dollar can make up lost ground as capital currents change will differ.

It is a basic tenant of trading that the more oversold or overbought a security is, the farther it can reverse course when the dynamics do change. Yet, how are we to assess the room for recovery for the greenback when we consider the Dow Jones FXCM Dollar Index (ticker = USDollar) closed out this past week at its highest level since September 2010. That does not seem like a currency that is overdue for a natural correction and simply needs a fundamental trigger to realize that rebalancing. Of course, the index’s positioning is heavily influenced by the USDJPY’s incredible rally these past five months; but there has also been considerable headway on GBPUSD, AUDUSD and USDCAD.

As such, a ‘risk aversion’ move can still certainly help the dollar out. Pairs like GBPUSD, though, will carry less intensity. Alternatively, those majors that have kept the pressure on the greenback – like EURUSD, AUDUSD and NZDUSD – can represent the bulk of the gains. And then, there may be even be a situation where the dollar can actually lose ground in a risk aversion. One of the most complicating pairs for traders to grasp is USDJPY. In a full-blown risk aversion move, this pair would actually drop. This isn’t because Japan is ‘safer’ than the US, but rather because there are will be far more carry unwinding for pairs like AUDJPY, EURJPY, etc that will bid the yen than there will be for demand for opening a new safe haven trade denominated in greenbacks.

However, the above is the mechanics of how a risk aversion move will play out for the dollar. Before this is ever realized, we actually have to see sentiment sour. On that front, my favored measure for risk trends is still the S&P 500 and other US equity indexes. Stocks are a good measure of investor activity, but the US indexes are also reflecting the most successful effort to this point to artificially negate risk through stimulus. That is where the dollar drew its strength against the euro and the S&P 500 was prompted to suffer its first weekly decline this year. Highly attuned to the longer-term outlook for low interest rates and continued support for risk takers, investors were shaken when they heard from the FOMC minutes that ‘many’ central bank members were concerned about the risks of more QE, a ‘number’ thought tapering stimulus may become necessary and ‘several’ thought they should prepare to ‘vary’ the pace of the program.

An ideal scenario for the dollar would be a global risk aversion move in which the Fed were actually tightening its monetary policy belt, but that is highly unlikely. A more likely, relative appeal within the coming weeks for the dollar would be to see the ECB respond to its own falling balance sheet with a new liquidity program and/or have Japan embark on its own open-ended easing program early than expected (Take this course to find out how a Currency War affects your FX trading?). Another ‘relative’ scenario that would benefit the dollar would be to see the Eurozone’s financial crisis revived. A factor that may very well hurt the dollar individual though is the ‘sequester’. The $1.2 trillion in possible automatic spending cuts are scheduled to be implemented March 1 if Congress cannot provide an alternative. Given the lack of progress, officials may let it go. Refer to the Fiscal Cliff lead in? – JK

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx