Key Points

- The Canadian dollar recently traded higher and broke the 82.80 resistance area against the Japanese yen.

- The CADJPY pair broke a bearish trend line with resistance at 82.60 on the hourly chart to clear the upside path.

- Today in Japan, the Current Account figure for Feb 2017 was released by the Ministry of Finance.

- The outcome was better than the last reading of ¥65.5B, as the trade surplus was ¥2,813.6B in Feb 2017.

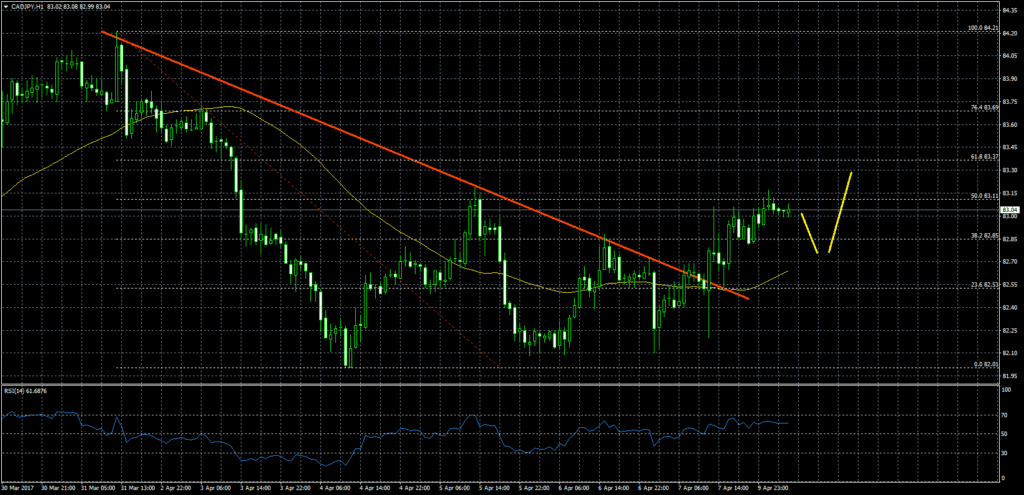

CADJPY Technical Analysis

The Canadian dollar after a decline towards 82.01 against the Japanese yen found support and moved higher. The CADJPY pair moved higher, and broke the 82.50 resistance along with a bearish trend line at 82.60 on the hourly chart.

The pair also moved above the 21 hourly simple moving average and 82.80 during the upside. Plus, there was a break above the 23.6% Fib retracement level of the last decline from the 84.21 high to 82.01 low.

At the moment, the pair is struggling near the 50% Fib retracement level of the last decline from the 84.21 high to 82.01 low. So, there is a chance of a dip towards the 21 hourly SMA or 0.8250 in the near term.

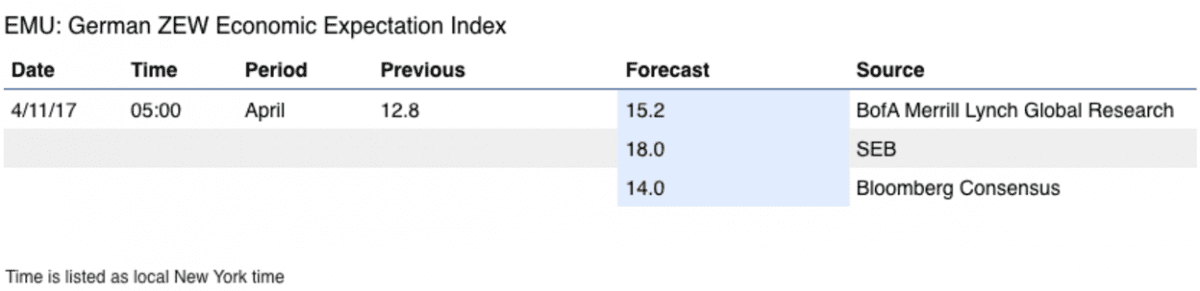

Japanese Current Account

Recently in Japan, the Current Account figure for Feb 2017 was released by the Ministry of Finance. The forecast was lined up for the net flow of current transactions, including goods, services, and interest payments to post a surplus of above ¥1000B in Feb 2017.

However, the result was better than the last reading of ¥65.5B, as the trade surplus was ¥2,813.6B in Feb 2017. When we look at the Trade Balance for Feb 2017 BOP basis, then the trade surplus was ¥1,076.8B, which was a lot better than the last deficit of ¥-853.4B.

Overall, there is a chance of CADJPY dipping a few pips towards 82.80-60, but it is likely to find support on the downside.