Fundamental Forecast for Australian Dollar: Bearish

Australian, Chinese Economic Data to Reinforce RBA Policy Standstill

Firming Bets on Fed Stimulus Withdrawal Likely to Hurt Aussie Dollar

Help Identify Critical Turning Points for AUD/USD with DailyFX SSI

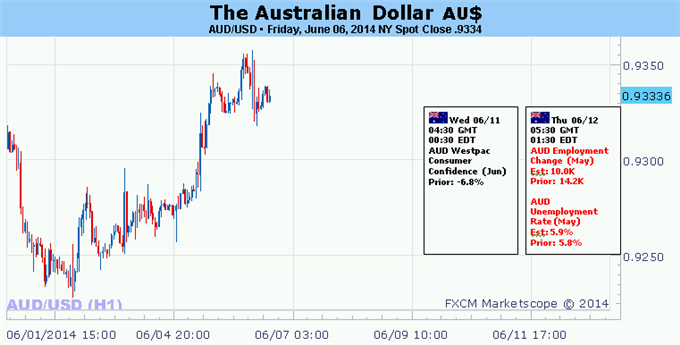

Domestically, the spotlight will be on May’s Employment data and a round of Chinese economic indicators. The former is expected to show hiring slowed, with the economy adding 10,000 jobs compared with the 14,000 increase in April. The jobless rate is expected to tick higher to 5.9 percent. Australian economic data has increasingly underperformed relative to expectations since mid-April, hinting economists are overestimating the economy’s performance and opening the door for downside surprises.

Meanwhile, Chinese news-flow has markedly improved over recent weeks, suggesting expected improvements in May’s trade, industrial production, retail sales and inflation figures may prove larger than what is implied by consensus forecasts. Taken together, this may reinforce the monetary policy standstill telegraphed in last week’s RBA rate decision, putting the onus on external factors to drive price action.

On the macro front, Federal Reserve policy speculation remains in focus. As we’ve discussed previously, the fate of the FOMC’s effort to “taper” QE asset purchases with an eye to end the program this year – paving the way for interest rate hikes – has been a formative catalyst for the markets this year. Last week’s supportive ISM data set, upbeat Fed Beige Book survey and marginally better-than-expected expected US jobs report sets the stage for continued reduction of monthly asset purchases and increasingly unencumbered speculation about outright tightening to follow.

The week ahead brings further evidence by way of May’s Retail Sales and PPI figures as well as June’s preliminary University of Michigan Consumer Confidence print. Improvements are expected on all fronts. Furthermore, US economic data has looked increasingly rosier relative to forecasts over the past two months, meaning surprise risks are tilted to the upside. That stands to narrow the Aussie’s perceived future yield advantage in the minds of investors. Firming bets on US stimulus withdrawal may likewise drive broader risk aversion. Needless to say, all of this bodes ill for the currency.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx