Fundamental Forecast for Australian Dollar: Neutral

AUD/USD Recovers From Within Striking Distance Of 2014 Low

Fundamental Backdrop Remains Unsupportive For Yield-Plays

Hopes For A Recovery Hinge On Profit-Taking From USD Longs

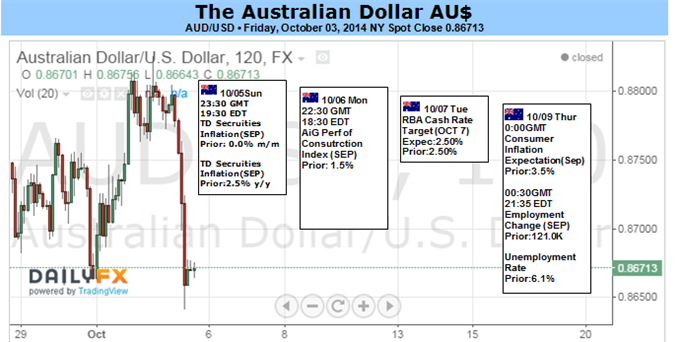

AUD/USD faced another turbulent week with the currency staging a remarkable recovery after falling to within inches of its 2014 low. There was no shortage of intraday swings throughout the week on the back of surprises to local economic data. Yet follow-through proved difficult amid fairly well-anchored RBA policy bets.

Over the coming week local jobs data headlines the domestic economic docket. Despite last month’s bumper employment change print the Reserve Bank is unlikely to change its tune until more consistent progress is made in the local labour market. Alongside recent mixed domestic data the central bank is likely to reiterate its preference for a ‘period of stability’ for rates when it meets next week.

The stable rate outlook may leave the Aussie’s comparative yield advantage intact. Yet amid elevated implied volatility levels the ‘carry trade’ has become a much less attractive, and risky proposition. Moreover, the recent slide for risk-appetite benchmarks, including the S&P 500, indicates investors are seeking safety over yields. This in turn suggests the AUD may need to search elsewhere for a source of inspiration to generate a recovery.

While AUD/USD faces a less-than-supportive fundamental backdrop a consolidation for the pair should not be precluded. This is based on the prospect of profit-taking on US Dollar longs, which recently reached their highest on record according to COT futures data. After several strong successive weekly advances traders may be tempted to take some chips off the table. For more on the US Dollar side of the equation read the weekly forecast here.

From a technical standpoint, sellers are likely sitting at the psychologically-significant 90 US cent level, which could keep the currency capped over the near-term. Downside risks are centered on the 2014 low at 0.8660, which if broken may set the scene for a descent on the July ‘10 low at 0.8320.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx