Fundamental Forecast for Pound:Neutral

– The EURUSD downtrend remains in place, and the daily 13-EMA is the key trend indicator to follow.

– Despite the ECB’s lack of new policies, EURUSD fell to fresh lows near $1.2500 after US NFPs.

– Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

The Euro was once again one of the worst performers last week, losing another -1.34% to the US Dollar, with EURUSD closing the week barely holding above the psychologically significant $1.2500 level. EURUSD has ceded ground in 11 of the past 12 weeks as the Dollar Index (DXY) has rallied for 12 consecutive weeks overall, an all-time record. While the better than expected US labor market report undoubtedly played a role in EURUSD’s swoon to new yearly lows, there is something to be said about the lack of enthusiasm for the Euro in the wake of the European Central Bank’s non-decision on Thursday.

The ECB’s decision to postpone any additional easing – sovereign QE a la the Federal Reserve – may make sense for market-centric reasons, but the decrepit economic situation in the Euro-Zone begs to differ. With a second TLTRO uptake scheduled for December and the ABS-program set to begin sometime in Q4, ECB policymakers feel that there is enough stimulus in the pipeline to warrant a ‘wait-and-see’ period before moving ahead with further easing.

Put simply, the ECB does not want to confuse and scare market participants with QE at present time. An additional dosage of stimulus now before the balance sheet review is revealed to the public – due at the end of the month – could be damaging to morale; not dissimilar from a patient being administered medicine before being told what ails her – she would be concerned she has a problem. So market participants are forced to bide their time until the AQR period comes to pass.

Whereas in years past non-action from a major central bank might be enough to spur an appreciation in her currency, traders made no efforts to lift the Euro out of its five month long free fall (that began on May 8, when the ECB unveiled its desire to do more on the easing front).

Market participants instead are acutely aware of the overhang of weak economic data in the Euro-Zone and its impact on inflation expectations. The Citi Economic Surprise Index EUR finished the week at -45.8, just off its yearly low set on September 3 at -53.8. The ECB’s preferred market measure of inflation, the 5Y5Y swaps, closed the week at 1.8316% – below the ECB’s medium-term target of at or just below +2%.

The lack of a Euro rally can thus be summarized: traders don’t necessarily believe in the current pipeline of stimulus, so economic weakness and falling inflation expectations are likely to persist; and because there won’t be any substantive bottoming of the fundamentals, pressure on the ECB will build until they actually move forward with a Fed-styled QE in the coming months.

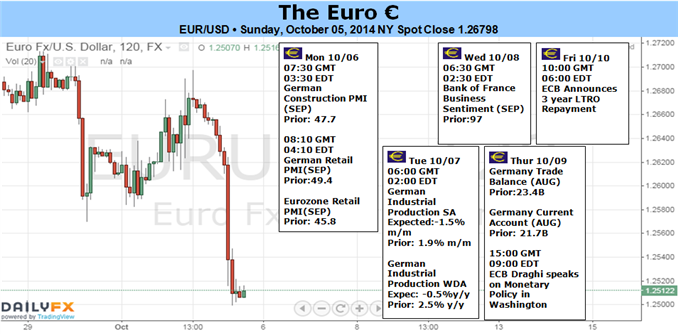

In light of the developments with the ECB and the Fed, it’s clear that EURUSD is becoming a much more data-driven pair going forward. That’s to say, the ECB will be looking for evidence that its latest efforts have slowed the economic downturn while the Fed will be setting the table for its first rate rise sometime in mid-2015. The calendar this week is a bit lighter than last, but the data reveal will begin right away with several European PMI surveys set to be released on Monday. See the DailyFX Euro and US Dollar Economic Calendars for the week of October 5, 2014 for this week’s events set to impact EURUSD. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx