Key Points

- The Euro traded lower recently versus the Japanese yen and broke a crucial support to signal more losses.

- The EURJPY pair jaw dropped and broke a major bullish trend line formed on the hourly chart.

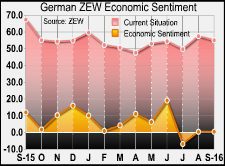

- Today, the Germany consumer price index was released by the Statistiches Bundesamt Deutschland.

- There outcome was expected, as there was no change in the CPI in August 2016.

EURJPY Technical Analysis

The Euro after reaching as high as 115.95 versus the Japanese yen found sellers and started moving down. There was a major bullish trend line formed on the hourly chart of the EURJPY pair, which was broken.

The pair also cleared the 21 hourly simple moving average to ignite further losses. The pair traded as low as 113.94 and currently attempting to correct higher.

However, the correction may not last long, as the 21 SMA and the 38.2% Fib retracement level of the last drop from the 115.95 high to 113.94 low may act as a resistance.

Germany Consumer Price Index

Today in the Euro Zone, the Germany consumer price index, which measures the average price change for all goods and services purchased by households for consumption purposes was released by the Statistiches Bundesamt Deutschland. The forecast was slated for no change in August 2016, compared with the previous month.

The result was in line with the forecast, as the German CPI came in at 0%. The report added that “Consumer prices in Germany were 0.4% higher in July 2016 compared with July 2015. The inflation rate as measured by the consumer price index increased slightly for the third consecutive month. This year, a somewhat higher rate than in July 2016 was measured in January (+0.5%). Compared with the previous month, the consumer price index rose by 0.3% in July 2016.”

The Euro bulls were not impressed by the report, and as a result, there can be more losses in the EURJPY pair going forward.