In a widely expected move for this month’s meeting, the RBA kept its cash rate steady at 1.50%, and repeated its view that the current level of the policy rate is consistent with sustainable growth and inflation returning to the target band over time. We do not expect another rate cut this year. The market is currently pricing in around a 35% chance of a cut by year-end; a repricing of these expectations would be positive for AUD. Stable yields in the short term should also see much demand for Kangaroo issuance (long-term bond issuance by non-Australian issuers in the Australian market) – a factor that has helped explain the resilience in AUD in recent years.

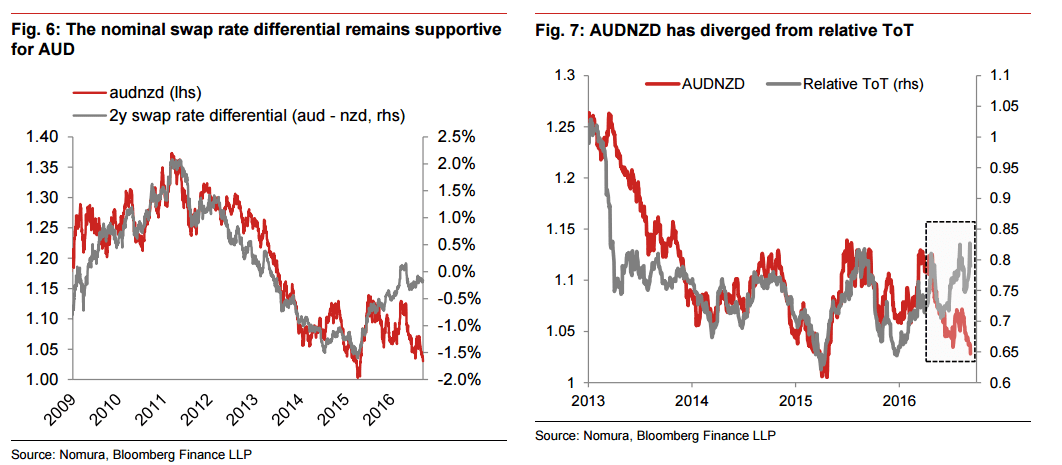

On the NZD side, the deflationary impact of a strong currency is making it difficult for the RBNZ meet its inflation objective. On a trade-weighted basis, NZD is currently 3.8% higher than at the August meeting, the highest level since April 2015 when RBNZ Assistant Governor McDermott delivered a very dovish speech in which he signalled that an easing in monetary policy was required. This may suggest the NZD TWI is reaching some important levels. While the Bank did express its ongoing concern regarding house price inflation, we continue to believe that the introduction of macroprudential measures to slow the market should allow the RBNZ to cuts rates more aggressively. Indeed, we believe that another rate cut is very likely before the end of the year (in November). While AUD/NZD has diverged significantly from the respective nominal swap rate differential since last year, the differentials should pressure AUD/NZD higher. The terms-of-trade is a significant driver of both AUD and NZD. Since June, AUD/NZD has diverged markedly from a historically very strong relationship with the relative ToT. It seems that the recent relative pick-up in commodity prices and Australia’s ToT has yet to translate into AUD strength.

Although a catalyst for a reversal is still lacking, we believe a shift in the current trend could materialise on different fronts: 1) an improvement in commodity prices beyond current levels, and 2) a cut in the RBNZ policy rate, with a more-dovish-than-expected communiqué. Moreover, speculative positioning in NZD is still heavily net long (currently hovering around all-time highs at 69% of total contracts traded), having increased consistently since March. AUD speculative positioning shows a net long reading as well (+40%), albeit at lower levels relative to history.

Overall, we assess that risks are tilted towards NZD positions unwinding in a more decisive manner, which would be AUD/NZD positive. We therefore like buying AUD versus NZD.

Copyright © 2016 Nomura, eFXnews™Original Article