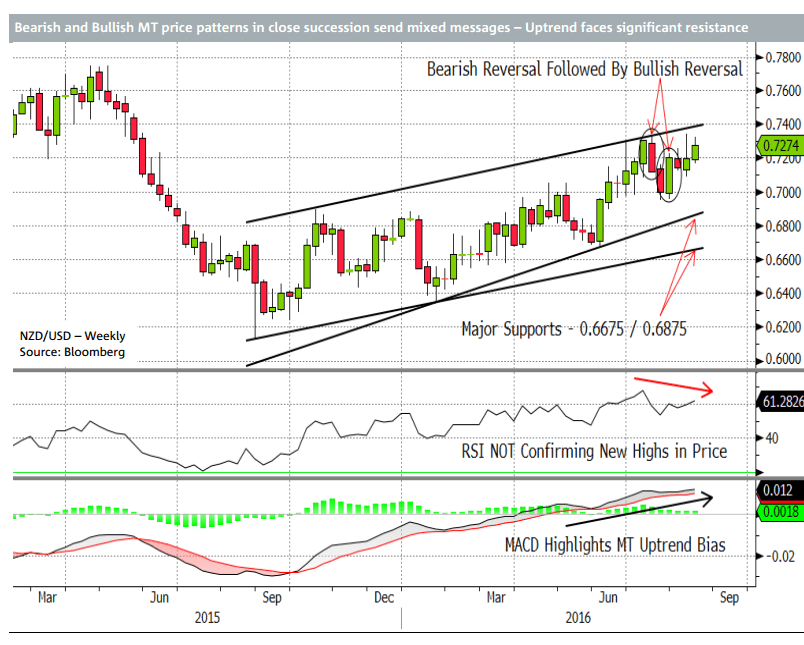

Trend: Price has maintained a broad uptrend channel bias since mid-2015. A new one-year high in price 5 weeks ago tested major resistance at the uptrend channel top at 0.7330/40 (high 0.7325). The subsequent weekly close below 0.7163 completed a bearish reversal week confirming that price had failed at the uptrend channel top. To our surprise the subsequent decline extended for only one further week ahead of a bullish reversal that renewed the uptrend bias and again produced a new uptrend high last week at 0.7341. This new high again failed to hold, highlighting the significant resistance faced by NZDUSD as it approached the top of its MT uptrend channel, now around 0.7380/00. The uptrend structure remains in play however resistance towards 0.7380/00 should continue to cap the uptrend on a multi-week basis.

Outlook: A textbook topping scenario in July failed to produce the downside targets that we anticipated and has subsequently been negated by the recent bullish reversal, amid renewed positive momentum bias. While this reinstates the one-year uptrend we see limitations to the uptrend in the coming weeks. Resistance at 0.7300/0.7400 is most likely to keep price in an approximate 0.7000/0.7400 multi-week range.

Copyright © 2016 NAB, eFXnews™Original Article