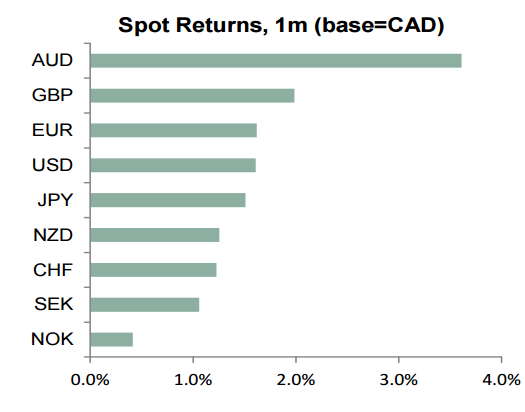

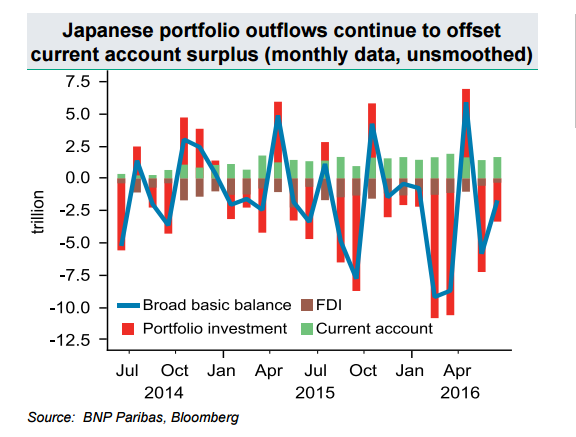

The last couple of weeks saw easing from the BoE, the RBA and the BoJ, and the Fed meanwhile presented a slightly upgraded economic outlook in its July statement. With the notable exception of GBP, the central bank’s actions did not have the desired impact on FX. Indeed, both JPY and AUD rebounded while USD weakened. The price action largely confirmed the notion that there are diminishing returns to monetary easing in an environment of falling global yields, weak global growth and inflation.

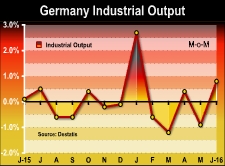

It further highlighted that constructive forward guidance does not count for much so long as the Fed is in data dependent mode. That said, it may also mean that investors will respond more strongly to evidence that domestic demand in the US remains resilient next week. With markets having pared back Fed rate hike expectations to 2018, chances are that the bar for USD-positive surprises is fairly low. We remain longterm-bullish on USD against the oil G10 currencies – NOK and CAD.

The BoE announced its version of 'shock and awe' and sent GBP lower across the board. It remains to be seen whether the measures can push the currency through the recent lows, however. Indeed, it seems likely that the bank will adopt a more data dependent approach from now on so that a 'one and done' easing package may have a limited negative FX impact over the longer-term. Next week's UK output data should be seen as dated and have less of an impact on the FX markets.

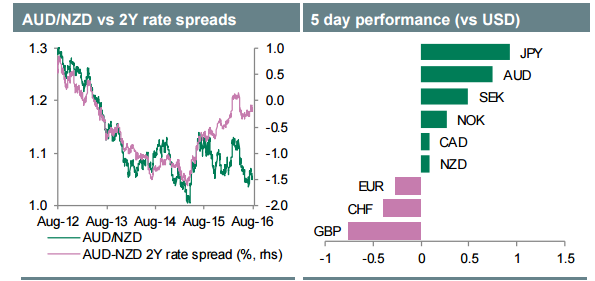

Next week, it will be the RBNZ’s turn to face the markets with expectations running high that the policymakers will deliver another 25bp cut4. The impact on NZD will depend on the rate decision, the aggressiveness of the bank’s forward guidance as well as investors demand for yield. Indications that the RBNZ is not done cutting rates and/or evidence that weaker commodity prices and underperforming global bank stocks are starting to depress the search for carry could weigh on NZD. We remain bullish on AUD/NZD from current levels.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article