We continue to expect GBPUSD to remain under pressure following the Bank of England’s comprehensive package of easing measures announced last Thursday and we think data in the week ahead will likely signal that the UK economy was slowing even before the Brexit vote. Our BNP Paribas STEER model signals 2y swap rates are the key driver of GBPUSD and, while UK rates are unlikely to fall much further, we see considerable scope for US rates to rise. We still target the pair well below 1.30 by the end of Q3.

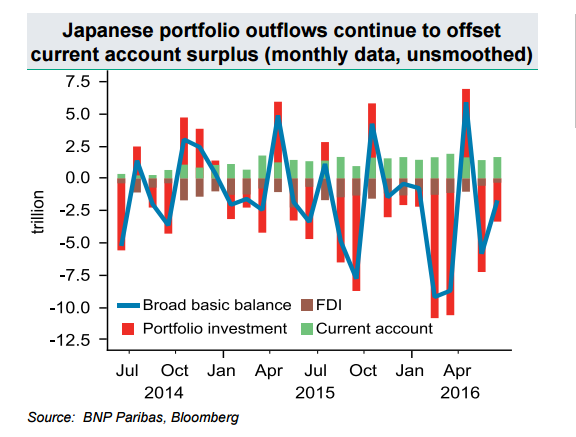

Japanese portfolio outflows continue to more than offset CA surplus Japan’s balance of payments data showed a larger than expected current account surplus (sa) in June, continuing the improving trend which started early 2014. However, portfolio outflows remained large at JPY 3trn, meaning that once again Japan’s broad basic balance was clearly in negative territory. Over the coming months we continue to favour positioning medium-term upside in USDJPY, driven primarily by a rise in US yields. However, over the next few days our BNP Paribas STEER model signals the pair could push lower and remains short the pair.

Copyright © 2016 BNP Paribas™, eFXnews™Original Article