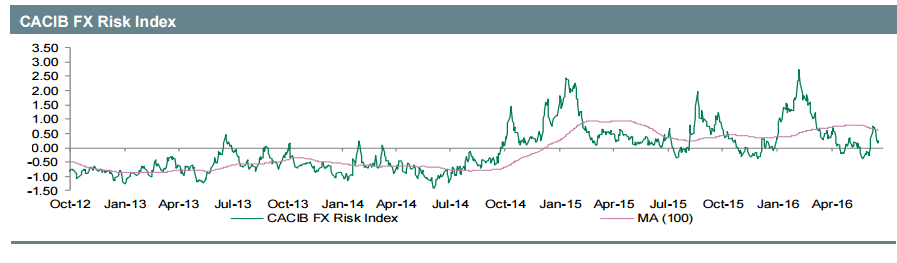

At 0.19 (vs 0.73 on 16 June) our Risk Index moved into less risk averse territory. The latest development is mainly due to somewhat higher expectations of the UK remaining part of the EU. That is at least suggested by the most recent polls. Nevertheless, polls remain too close in order to indicate tomorrow’s outcome reliably. If anything it remains our base case that the UK stays as part of the European Union and such an outcome should make a case of further improving risk sentiment, at least in the short-term.

In G10 FX the EUR has become more positively correlated with risk appetite. This comes as no surprise as the single currency has been used as a cross hedge over the last few weeks. Hence, the avoidance of a Brexit may initially trigger more upside. The same holds true when it comes to the USD.

The greenback appears to have been used as a safe haven currency. This is at least suggested by our FX positioning data that indicated rising demand for the USD during more unstable market conditions. Accordingly it cannot be excluded that the USD’s initial reaction to a positive outcome of tomorrow’s referendum will be a negative one.

From a broader angle it must be noted that falling external risks will support the Fed in focusing on domestic conditions, which we expect to rebound over time. Hence, USD downside is likely to prove corrective.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article