Primarily reflecting a sharp increase in initial jobless claims, the Conference Board released a report on Thursday showing an unexpected decrease in its index of leading U.S. economic indicators.

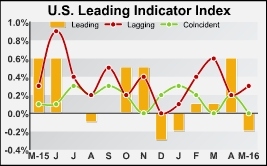

The Conference Board said its leading economic index edged down by 0.2 percent in May after climbing by 0.6 percent in April.

The modest decrease by the leading index came as a surprise to economists, who had expected the index to rise by 0.2 percent.

The pullback by the index reflected negative contributions from initial jobless claims, stock prices, and average consumer expectations for business conditions.

Meanwhile, positive contributions from the interest rate spread, the Leading Credit Index, and manufacturers' new orders for non-defense capital goods excluding aircraft helped limit the downside.

"While the LEI suggests the economy will continue growing at a moderate pace in the near term, volatility in financial markets and a moderating outlook in labor markets could pose downside risks to growth," said Ataman Ozyildirim, Director of Business Cycles and Growth Research at the Conference Board.

The report also said the coincident economic index was unchanged in May following a 0.2 percent increase in April.

Positive contributions from personal income less transfer payments, manufacturing and trade sales and employees on non-farm payrolls were offset by a negative contribution from industrial production.

Meanwhile, the Conference Board said the lagging economic index rose by 0.3 percent in May after edging up by 0.2 percent in April.

The increase reflected positive contributions from five of the seven index components, including the average duration of unemployment, the ratio of consumer installment credit outstanding to personal income, and commercial and industrial loans outstanding.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News