Asian shares got pounded on Monday with the Japanese Nikkei index tumbling as much as 4 percent in early trade as major exporters sold off sharply, with shares of Toyota down 4.55 percent, Nissan down 5.13 percent and Honda off 4.73 percent in the wake of a stronger yen.

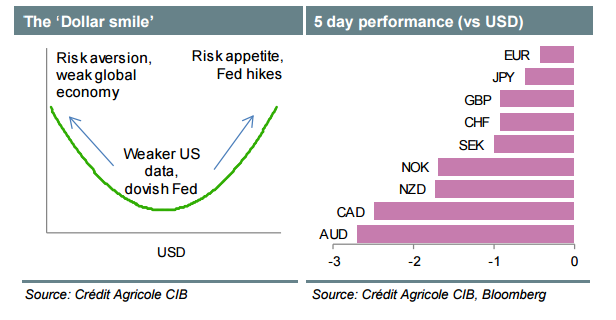

The yen climbed to a fresh 18-month high against the greenback early on Monday after its biggest weekly gain in over seven years as forex traders doubt Tokyo policymaker's ability to intervene to stem its rise.

USD/JPY dropped as far as 106.11, breaking through Friday's low of 106.27. Last week, the pair slipped almost 5 percent – its largest percentage fall since 2008 – after the Bank of Japan refrained from adding fresh stimulus.

Finance Minister Taro Aso was quoted in Japanese media over the weekend as being unhappy with the yen's strength, saying it was "extremely concerning".

With Japan's financial markets closed for holidays from Tuesday to Thursday, investors are not ruling out a move to test the low of 105 on the pair given lack of buying from Japanese importers. EUR/JPY held firmer above 122.00, but still within sight of a three-year trough around 121.66 set last Friday.

EUR/USD nudged up to a fresh 6 1/2-month high of 1.1484, as the Dollar Index dropped to an 8-month low.