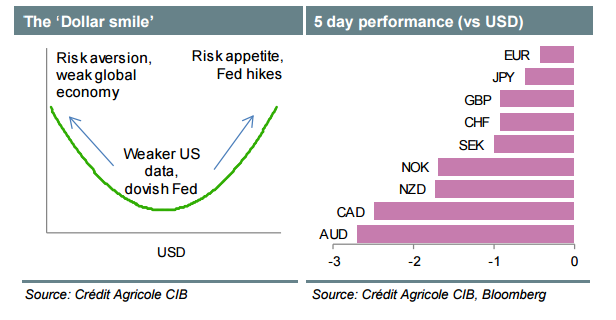

The USD (represented by the DXY) continues to recover back some of the previously lost ground as it verges back to the 20-day MA around 94.11. It has been a positive week for the buck as it recovers from a previous 6-day decline and ahead of the US Nonfarm payrolls (NFPs) due today.

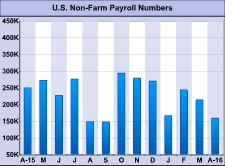

The US economy is expected to have created 200k jobs in April and unemployment is expected to have marginally eased lower to 4.9%. Actual figures out at 1430CET.

US equity close showed mixed results as we moved closer to the eagerly awaited NFPs. Sentiment in Asia however turned worse as the RBA lowered its inflation forecasts and left intended that further rate cuts were still in the cards.

The ADP figure, which is largely considered a precursor for the NFPs, came in significantly lower than expected last Wednesday – so it is likely that we some nervousness exacerbated by the usual hesitancy characterising high impact data such as this.

Needless to say the highlight of today’s economic docket shall be the US labour data, coinciding at the same time there will also be the release of the Canadian Unemployment rate.

Happy Weekend !