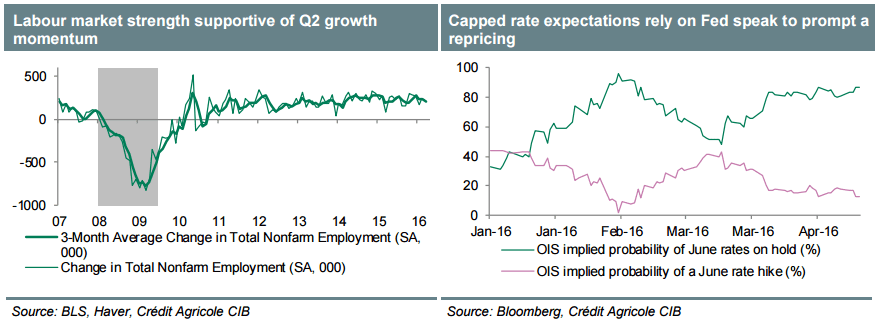

With the Fed undecided on a June rate increase, we believe the outcome will depend on Fed commentary for a repricing of rate expectations to occur in the coming weeks. Indeed, the market response to the constructive Q1 GDP release was muted on the back of a cautious Fed.

Additional incoming data, however, will be the key driver of any upgrade to Fed rhetoric. Fed officials want to see more evidence that the Q1 slowdown was temporary, with growth set to reaccelerate in the second quarter on the back of robust consumer fundamentals (real income and sentiment) and continued strength in labour market conditions, as stressed in the April FOMC statement. The heavy data flow in the week ahead centres on the April jobs report for further support to this view.

We expect April nonfarm payrolls to rise by 190K vs. 215K in March…The April unemployment rate may decline marginally but is likely round to 5.0% rather than 4.9%

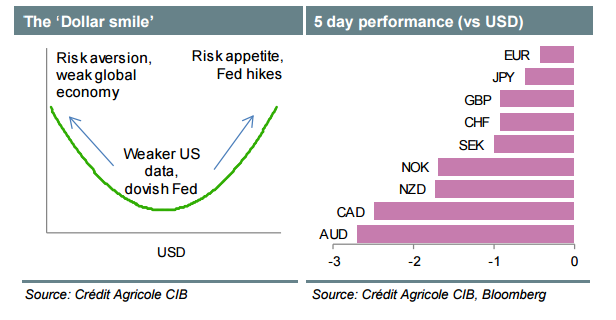

Given a sustained recovery in global financial conditions, we expect the data to come in stronger and Fed commentary to sound more constructive. But, until then, the USD should continue to struggle, particularly against commodity currencies.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article