Key Points

- The Aussie dollar after trading as low as 85.30 found support and recovered against the Japanese yen.

- The AUDJPY moved higher and broke a contracting triangle pattern at 85.70 on the hourly chart.

- Today in Japan, the Eco Watchers Survey index was released by the Cabinet Office.

- The result was not as the market expected, as there was a decline from the last reading of 51.4 to 49.8 (current) in Jan 2017.

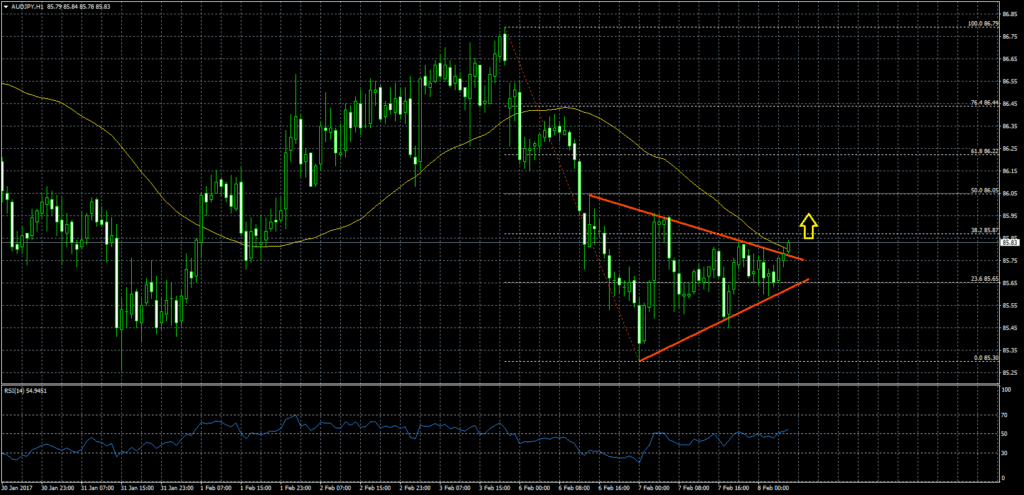

AUDJPY Technical Analysis

The Aussie dollar recently fell towards the 85.30 level against the Japanese yen, where it found support and moved higher towards 85.60. The AUDJPY pair managed to gain momentum, and cleared a contracting triangle pattern at 85.70 on the hourly chart.

The pair is also attempting to move above the 21 hourly simple moving average at 85.80. However, the 38.2% Fib retracement level of the last decline from the 86.79 high to 85.30 low is acting as a resistance.

So, a break above the stated fib level at 85.87 is needed for a push towards 86.00. The chances are higher of a move towards the 50% Fib retracement level of the last decline from the 86.79 high to 85.30 low at 86.05.

Japanese Eco Watchers Survey Index

Today during the Asian session, the Eco Watchers Survey index, which closely watches region-by-region economic trends was released by the Cabinet Office. The market was not expecting a decline below 50 in Jan 2017.

However, the result was below the forecast, as there was a decline from the last reading of 51.4 to 49.8 (current) in Jan 2017. Looking at the outlook index, there was a decline from 50.9 to 49.4 in Jan 2017.

Overall, it looks like the Japanese yen may continue to decline and the AUDJPY pair could trade towards 86.00 or might even break it for a move towards 86.20.