The US dollar was confined to narrow ranges against its major rivals on Thursday, ahead of tomorrow's non-farm payrolls report that may strengthen expectations that the US Federal Reserve will hike interest rates by December.

The battered sterling slipped 0.2 percent so far this morning. GBP/USD trades at 1.2730 after dropping to as low as 1.2686 on Wednesday, its weakest in more than three decades on fears of the impact of Britain's impending exit from the European Union.

Comments by Chicago Fed President Charles Evans who said he would be "fine" with raising US interest rates by year-end if economic data remained firm, supported the dollar.

On the economic data front on Wednesday, strong US services sector activity offset a weaker-than-expected print on private-sector ADP employment report ahead of Friday's jobs data.

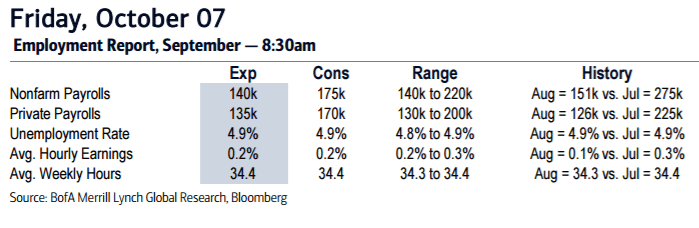

The monthly employment numbers are expected to show 175,000 jobs were added in September, according to market participants.

Forex investors will also look for any upward revision to August's weaker-than-expected gain of 151,000 jobs.

The dollar eased off from its resilient attack of Japanese counterpart. USD/JPY traded at 103.62 at the time of writing, just off a four-week high of 103.73 touched on Wednesday.

EUR/USD was back below 1.1200, after it was initially supported by higher European bond yields on concerns the European Central Bank might taper the pace of bond-buying before its asset purchase program ends.