Yen to Extend Losses as Stagnant Price Growth Undermines BoJ Pledge

Fundamental Forecast for Japanese Yen: Bearish

Yen Slightly Weaker vs. US Dollar After BOJ Policy Announcement

Weekly Price & Time: USD/JPY Overcomes Key Resistance Zone

For Real-Time Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

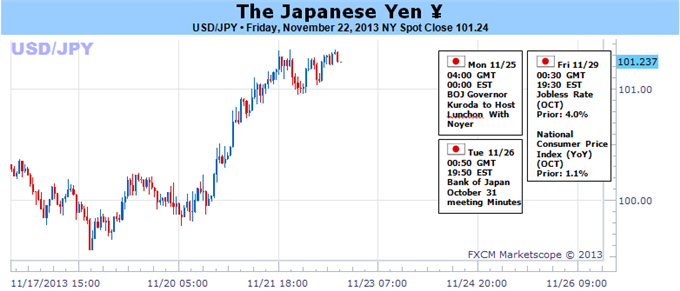

The USDJPY rally may gather pace during the final week of November as the slowing recovery in Japan undermines the Bank of Japan’s (BoJ) pledge to achieve the 2% target for inflation by 2015, and the deviation in the policy outlook may continue to spur higher highs in the exchange rate as the Fed looks to taper its asset-purchase program in the coming months.

The fundamental developments due out next week may produce additional headwinds for the Yen as the headline reading for Japanese inflation is expected to hold steady at an annualized rate of 1.1% in October, but a weaker-than-expected print may put increased pressure on the BoJ to further embark on its easing cycle in order to encourage a stronger recovery.

Nevertheless, it seems as though central bank Governor Haruhiko Kuroda will retain a wait-and-see approach for the foreseeable future as Prime Minister Shinzo Abe continues to draw up the ‘Third-Arrow’ stimulus package, and the BoJ Minutes may continue to strike a rather neutral tone for monetary policy as the board vows to make policy adjustments as needed. At the same time, there appears to be a growing rift within the central bank as board member Takahide Kiuchi argues to alter the wording attached to the forward-guidance for monetary policy, and the central bank may have little choice but to implement more non-standard measures before the ‘Third Arrow’ is unveiled as the structural reforms are anticipated to drag on the economy.

It looks as though it will only be a matter of time before the USDJPY threatens the July high (101.52), and the pair may continue to retrace the decline from back in May (103.72) as the bullish formation continues to take shape. However, as we head into the end of November, month-end flows may produce whipsaw-like price action across the currency market, while the Thanksgiving Holiday may generate unfavorable trading conditions as market participation thins. – DS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx