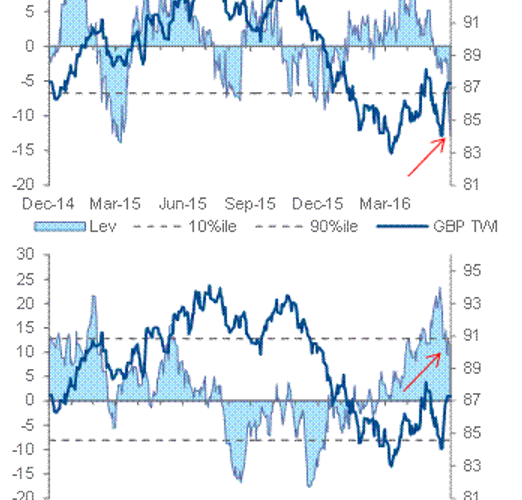

Positioning has led to the ongoing bounce in GBP, but there are more clients left to sell. Price action today should convince you Leveraged interest in adding to GBP downside here may be somewhat limited. Figure 2 shows that on a 1m horizon GBP outflows are at the strongest we've recorded since 2012 (literally the 0th % ile). It is too early to call how the long-term capital will behave, but we suspect there will be more GBP selling to come.

Chart 3 suggests Real Money has been net-GBP buyers since March, but the referendum shifts significantly the growth and investment outlook. With the UK still holding large twin deficits (and unlikely to find enough inflows to balance them), it unlikely this client type is comfortable with the level of exposure or the exchange rate.

On EUR the bottom line is its tough to sell with a 30bn/mo current account surplus. Brexit doesn't imply ECB policy changing or EZ breakup anytime soon, so the FX market doesn't have an immediate driverfor capital outflows. Our view is it might be better risk/reward to position in CDS or Equities if you are trying to position for EZ tail risk, not FX.

Broadly EURUSD should respect the 1.15-1.05 range, with the trigger for it lower is when GBP selling gets more aggressive.

Copyright © 2016 CitiFX, eFXnews™Original Article