US Dollar Ready for Break…But Direction Awaits Volatility or Fed

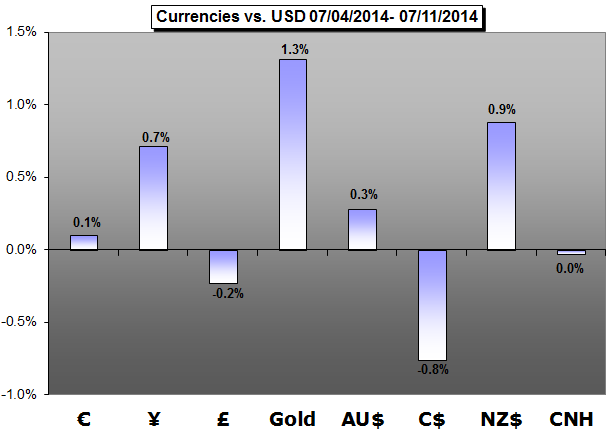

The Dow Jones FXCM Dollar Index (ticker = USDollar) continues to linger conspicuously close to a level that has held the floor on the currency for the past 16 months. Whether the assessment is technical or fundamental, the signs point to a meaningful break for the greenback in the near-term future. However, the direction the market chooses and the commitment to a new trend’s continuity depends on how underlying market conditions evolve and whether the rate forecasts start to solidify.

British Pound May Fall as Soft Inflation Data Undermines BOE Bets

Monetary policy expectations remain firmly in the driver’s seat for the British Pound. Indeed, the correlation between GBPUSD and the UK 2-year Gilt yield – a reflection of investors’ near- to medium-term interest rate outlook – is now at a one-month high (0.42 on 20-day percent change studies). Last week’s BOE announcement proved to be a non-event, with Mark Carney and company leaving the setting of monetary policy unchanged and publishing no explanatory statement to lay out their reasoning going forward.

Gold Breaks Through July Range- Rally at Risk Ahead of Yellen

Gold prices are higher on the week with the precious metal up more than 1% to trade at $1335 ahead of the New York close on Friday. The advance marks the sixth consecutive weekly advance and comes on the back of a poor performance in broader equity markets and growing geopolitical tensions in the Middle East. Major US stock indices were off by more than 1% this week with European bourses shedding 3%-4% across the board amid concerns over the health of the Portuguese banking system.

Japanese Yen Losses Remain Likely, but What Could Change?

The Japanese Yen finished the week marginally higher versus the US Dollar, but the fact that it trades near critical resistance (USDJPY at support) leaves it at risk. We’ll watch the coming week’s Bank of Japan interest rate decision with special interest.

We expect little change from the BoJ and indeed the Dollar/Yen exchange rate seems likely to stick to its year-to-date trading range.

NZD/USD Risks Fresh Record-Highs Ahead of RBNZ on Faster Inflation

The NZD/USD remains at risk of marking fresh record-highs ahead of the next Reserve Bank of New Zealand (RBNZ) policy meeting on July 23 as the economic docket is expected to show heightening price pressures across the region.Indeed, the headline reading for New Zealand inflation is expected to increase an annualized 1.8% in the second-quarter, which would mark the fastest pace of growth since the last three-months of 2011, and heightening price pressures may generate a further advance in the exchange rate as it fuels interest rate expectations.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx