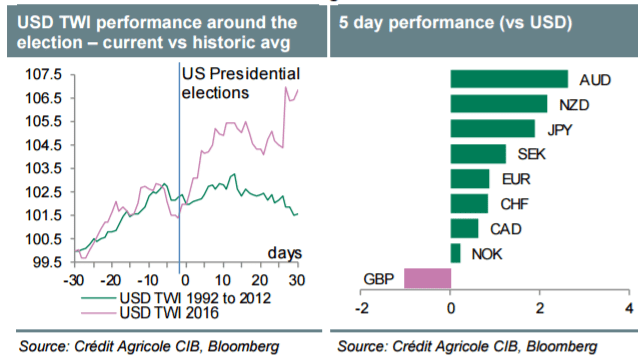

The Presidential inauguration on 20 January will start the clock on the first hundred days of the Trump administration – a period where investors expect to see the hopes that have fuelled the USD rally since last November as confirmed. Indeed, the risk of disappointment due to bipartisan politics in Congress or delays on the back of a lengthy ‘vetting’ process for some of Trump’s nominees is non-negligible. That said, we expect Trump to start delivering on at least some of his policy pledges, ranging from comprehensive tax reform and deregulation to the erection of trade barriers against selected countries in Q1.

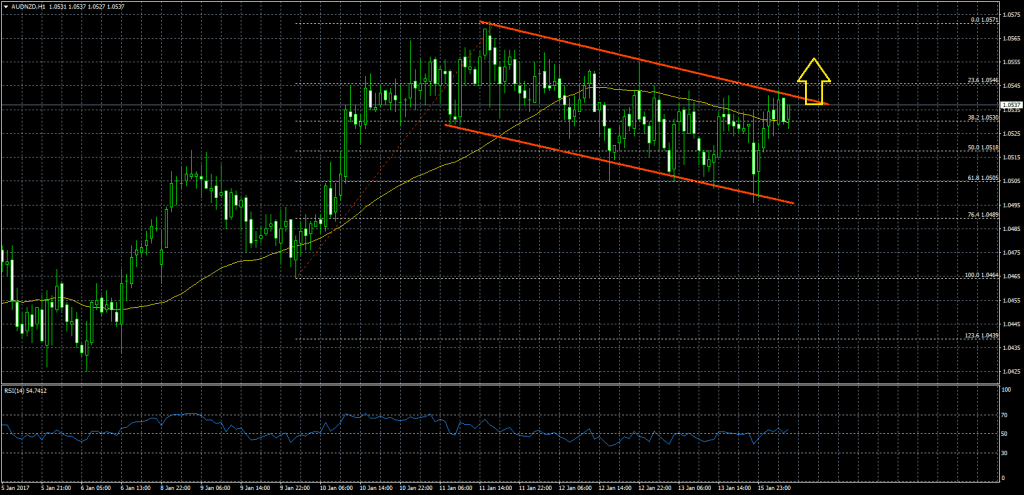

Even though we recognise that some positives are in the price we maintain our bullish USD view, expecting further convergence between the Fed and market’s rate hike expectations to boost the rate advantage of the currency. In addition, US tax reform should trigger repatriation inflows into the USD. Last but not least, we suspect that the FX markets are still to fully price in the risk of US protectionism, which should weigh on global risk sentiment, trade and growth. We thus see further USD outperformance vs risk-correlated and commodity currencies like AUD and CAD, and expect FX vols to advance in the coming months.

Our medium-term bullish USD view notwithstanding, we suspect that it may take concrete details of Trump’s economic plan for the USD-rally to resume in earnest. In the near-term, markets could remain in a ‘holding pattern’ with FX investors waiting for fresh incentives to buy USD. The US data and the Fed speakers next week should support market expectations of pacier rate normalisation and prevent further erosion of the existing USD-longs, however.

Elsewhere, the ECB and the BoC policy meetings will attract some attention even if they may fail to leave a lasting imprint on the markets. Indeed, both meetings should reiterate the banks’ current policy outlook. That said, we maintain our view that the current levels in USD/CAD represent an interesting buying opportunity and stick to our long position.

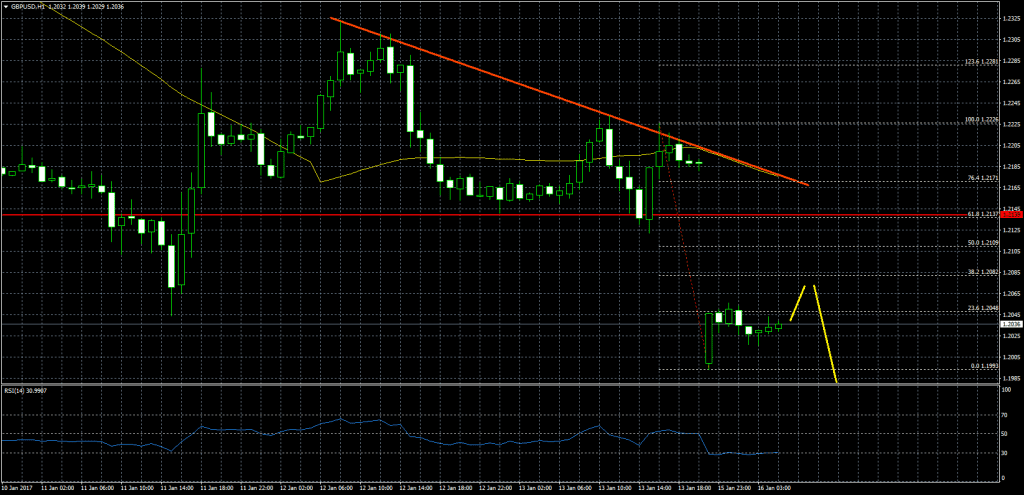

EUR could continue to underperform smaller currencies like SEK and NOK but outperform GBP. The outlook for the latter remains clouded by lingering political uncertainty ahead of Brexit (PM May will speak on the Brexit negotiations next Tuesday) and data that could confirm the recent weakening of the UK labour market.

Copyright © 2017 Credit Agricole CIB, eFXnews™Original Article