The OPEC deal to cut production for the first time in eight years provided a boost to oil prices and risk sentiment. Also supportive were the waning prospects for a Trump win at the November presidential election after the first televised debate. Last but not least, more upbeat Fed rhetoric and US data of late does not seem to translate into growing rate hike expectations, and thus it is a worry for the markets. Demand for carry and commodity currencies remains in place for now but we are not convinced that their gains can be sustained from here.

Indeed, abating pre-election risks and recovering oil prices should strengthen the case for a Fed hike in December. Next week's non-farm payrolls and manufacturing ISM could become triggers of renewed USD strength.

CAD’s recent outperformance is starting to fade and the currency looks vulnerable ahead of the Canadian labour data next week, which could add to the stream of disappointing releases of late.

AUD has benefited from the recent rebound in sentiment and the upcoming RBA meeting need not stand in the way of further resilience especially if the policy statement echoes recent comments by Governor Lowe that the bank will not 'overreact' to the weaker Australian inflation data of late. If anything, we prefer to express any constructive AUD vs its antipodean counterpart NZD.*

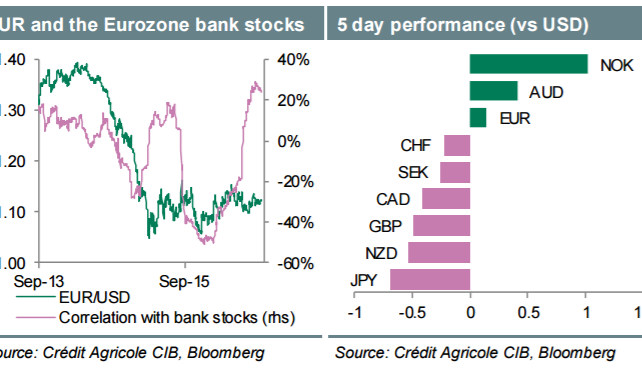

EUR came under pressure on the back of market woes about Deutsche Bank. A potential escalation of investors’ fears about the banking sector’s outlook could become a drag on EUR vs USD, JPY and CHF, given its growing correlation with the Eurozone bank stocks. That said, EUR’s safe haven appeal should shine through eventually and limit the downside risks. As argued in the editorial, the single currency is supported by, among other things, the unwinding of short-EUR hedges as foreign investors try to flee the Eurozone capital markets. European risk-correlated currencies with close ties to the epicentre of the turmoil, like Scandies, could struggle to perform as well.

Fears about a ‘hard Brexit’ as well as bank stock underperformance have weighed on GBP of late. While the Conservative party conference (2-5 October) could shed some light on the Brexit deal pursued by PM May, investors may be left guessing for now. With no escalation in the Brexit threat imminent, the risks ahead of the upcoming UK data could be tilted to the upside for GBP. We expect evidence of stable UK growth to dampen expectations of further BoE easing and support GBP.

*This trade is tracked and recorded in eFXplus Orders.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article