Investors’ uncertainty ahead of the French presidential election has abated of late.

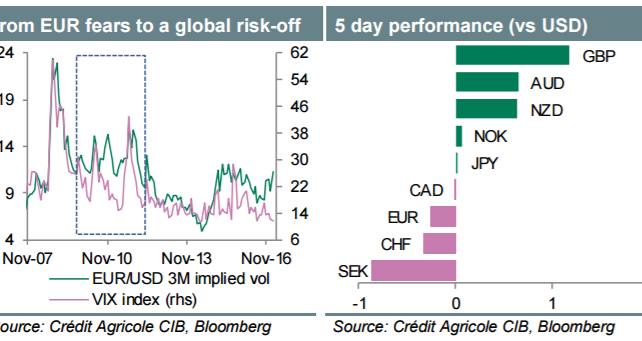

The EUR outlook should remain very volatile, driven by swings in pre-election polls, however. Time and time again we have also seen concerns about the integrity of the Eurozone fuelling bouts of global risk aversion in recent years. It may thus be only a matter of time before we see contagion from the EUR selloff into less liquid, risk-correlated G10 currencies. In that respect, we suspect that NOK and SEK may be the most vulnerable given their close economic ties to the Eurozone.

GBP may not lag far behind, especially if UK data continues to underwhelm or Brexit-related uncertainty returns.

Looking at next week, positive surprises from Eurozone flash HICP data may offer some support for EUR. That said, any bounce may be sold into by still wary FX investors…. In our portfolio we remain short EUR against USD in spot and JPY via options.*

President Trump’s speech to Congress could offer further clarity on the upcoming fiscal stimulus measures and together with second-tier US data and Fed speakers, it could encourage renewed frontloading of rate hike expectations and breathe new life into the waning long-USD trade.

The BoC should keep its policy outlook unchanged in March, leaving CAD at the mercy of global factors like risk sentiment and commodity prices. Australia should record a strong rebound in GDP growth and activity data out of Sweden will also attract some attention as well but may have a less sustained impact on the markets with investors still scrutinising the latest French polls.

*This trade is recorded in eFXplus Orders.

Copyright © 2017 Credit Agricole CIB, eFXnews™Original Article