There are three key drivers of G10 FX markets at present.

The first is the Fed’s gradual policy normalisation, which has seemingly moved up a gear recently.

The second seems to be President Trump, who, at least for now, is associated mainly with still uncertain prospects for US fiscal stimulus. The President could become a source of market anxiety about rampant US protectionism before long as well in our view.

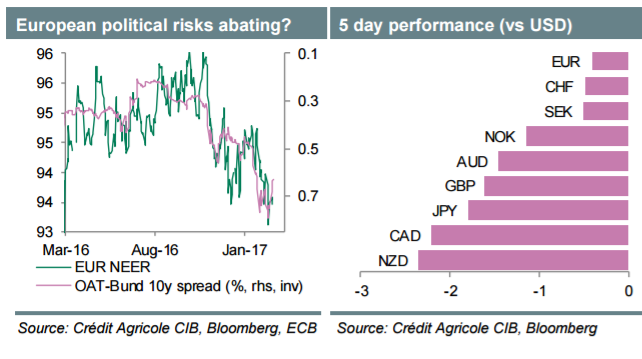

Last but not least, Eurozone political risks remain an important driver of the outlook for EUR and European G10 currencies.

…We continue to expect gradual USD gains for a total appreciation of 3%-5% in trade-weighted terms by Q3 of this year. Our bullish USD view remains constrained by the expectations that US fiscal stimulus is likely to be moderate and probably won’t be delivered until 2018.

Copyright © 2017 Credit Agricole CIB, eFXnews™Original Article