Chart – Created Using FXCM Marketscope 2.0

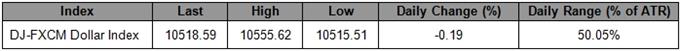

Although the Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) is trading 0.19 percent lower from the open, the Federal Open Market Committee (FOMC) interest rate decision could be the game-changer for the greenback should the central bank look to taper its asset-purchase program. As the reserve currency carves a higher low in June, a less-dovish Fed may prompt the USDOLLAR to breakout of the downward trend carried over from the previous month, and we may see the index resume the upward trend from earlier this year as the central bank appears to be moving away from its easing cycle. In turn, we should see the rebound from 10,469 gather pace over the remainder of the week, and currency traders may turn increasingly bullish against the USD should we see a growing number of Fed officials strike an improved outlook for the world’s largest economy.

With all the headlines highlighting a reduction in the Fed’s quantitative easing program, the FOMC may use this opportunity to outline a more detailed exit strategy, and the central bank may sound more upbeat this time around as it anticipates a stronger recovery in the second-half of the year. Rather than outlining a timeframe to taper its asset-purchase program, the central bank may lay out a tentative amount to reduce the $85B monthly purchases at different intervals, and the shift in the policy outlook may spark a more meaningful run at the 10,900 handle as market participants scale back bets for additional monetary support. In turn, we may see the rebound in the USDOLLAR turn into a more meaningful rally in the coming days, and we will look for a higher high in the index as the bullish trend continues to take shape.

All four components strengthen against the greenback, led by a 0.46 percent advance in the Australian dollar, but the higher-yielding currency remains poised to face additional headwinds over the near to medium-term as the policy outlook continues to point to another rate cut from the Reserve Bank of Australia (RBA). As headlines coming out of China – Australia’s largest trading partner – continues to highlight the risk of seeing a ‘hard-landing,’ central bank Governor Glenn Stevens may look to further insulate the $1T economy, and we should see the RBA continue to embark on its easing cycle over the coming months in order to encourage a stronger recovery. Although the AUDUSD looks poised for a large rebound, we may see a muted correction in the exchange rate as interest rate expectations remain tilted to the downside, and the bearish trend dating back to 2011 should continue to take shape as the fundamental outlook for the region remains weak.

— Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Bring the economic calendar to your charts with the DailyFX News App.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx