Key Points

- The US Dollar recently found resistance near 116.80 against the Japanese yen and traded lower.

- There was a bullish trend line on the hourly chart of USDJPY, which was broken at 115.30 for more downsides.

- Today, the Japanese Eco Watchers Survey was released by the Cabinet Office.

- The result was above the forecast, as there was a rise from the last reading of 49.1 to 50.9 in Dec 2016.

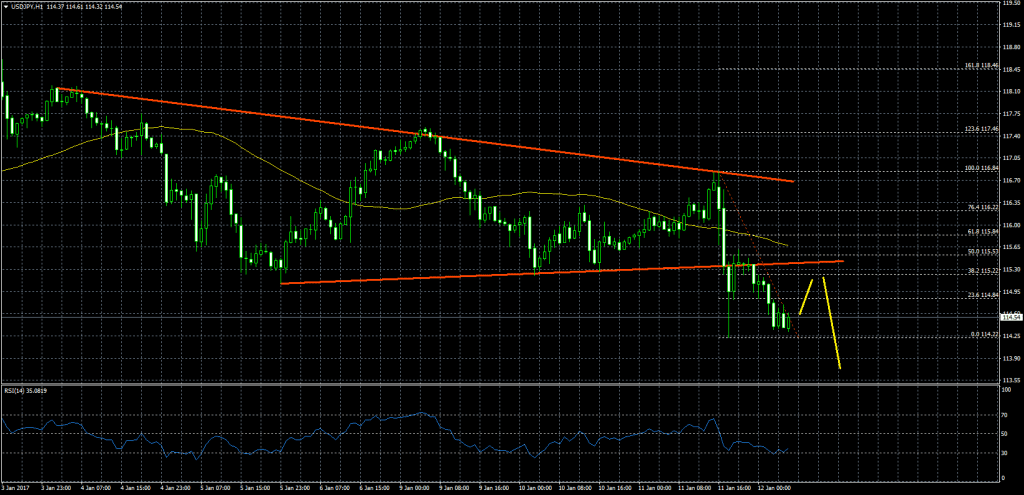

USDJPY Technical Analysis

The US Dollar was seen trading lower after it failed to break the 116.80 resistance against the Japanese yen. The USDJPY pair moved down, and broke a bullish trend line on the hourly chart at 115.30 for a break towards 114.50.

The pair recently traded as low as 114.22 and currently attempting to correct higher. It looks like the current correction won’t last long and the pair may face sellers near the 23.6% Fib retracement level of the last decline from the 116.84 high to 114.22 low.

If you are looking to sell, then consider it on rallies. Look for a break below 114.25 for a downside move towards 114.00 at least in the short term with a tight stop loss.

Japanese Eco Watchers Survey

Today during the Asian session, the Japanese Eco Watchers Survey, which closely watches region-by-region economic trends was released by the Cabinet Office. The market was not expecting any major increase in the Outlook index in Dec 2016.

The result was above the forecast, as there was a rise from the last reading of 49.1 to 50.9 in Dec 2016. Moreover, the Eco Watchers Survey Current Index also posted an increase from the last reading of 48.6 to 51.4 in Dec 2016.

Overall, it looks like the Japanese yen may continue to trade higher, and USDJPY pair could break 114.20 for a move towards 114.00.