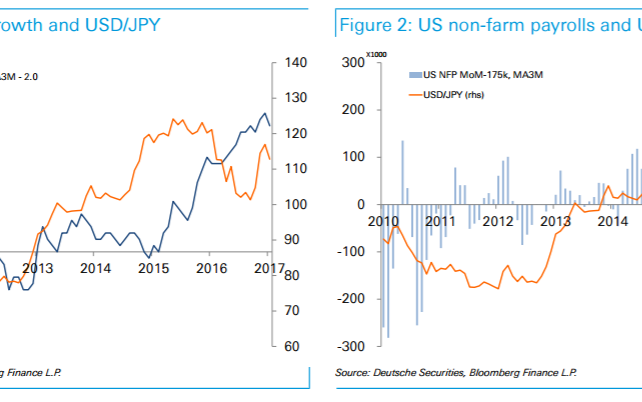

January US nonfarm payrolls (announced on 3 February) were firm, rising 227,000 MoM. In contrast, wage growth was weaker than expected, up just 0.1% MoM and 2.5% YoY. This caused the yen to weaken slightly in 112s range on the view that a March rate hike is less likely. The payroll data is positive for our bullish medium-term outlook on dollar/yen..

In the near-term, we see dollar/yen as likely to trade back and forth between in low-110s level. We also cannot necessarily rule out the risk of the yen falling to 110 or below during the current adjustment.

However, at this point we do not see fiscal policy disappointment, postponed rate hikes and a slowing economy as a realistic main scenario. We think it appropriate to maintain our basically bullish view on dollar/yen and wait patiently for the end of the current adjustment.

Copyright © 2017 DB, eFXnews™Original Article