Another place where equities help is with yen weakness. As Japan market activity returns to normal, the Nikkei is moving higher. Higher equity prices equal a weaker yen and even if the causality is firmly from FX to equities the correlation allows the two to feed off each other. USD/JPY around 118 after US yields backed off is not much of a correction and 118.70 is the key level to watch before we see a move through 120.

We’re happy to stay short GBP/USD too. Despite robust UK data. The political backdrop remains an anchor round the pound’s neck, but market pricing of Fed and MPC moves in the next year is still diverging.

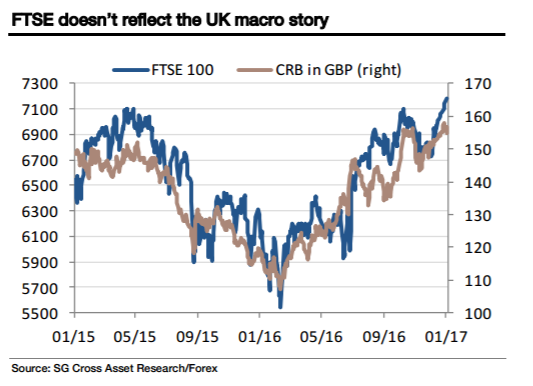

This morning’s 107bp spread between December short sterling and Eurodollar 3-month futures is testing new historic wides. That’s lovely for the FTSE, but as the chart of the CRB index in sterling terms shows, the equity market’s strength may reflect strong sterling commodity prices more than anything terribly enticing about the UK macro outlook.

*SocGen maintains a short GBP/USD position from 1.2590.

*This trade is recorded and updated in eFXplus Orders.

Copyright © 2017 Societe Generale, eFXnews™Original Article