Fundamental Forecast for Japanese Yen: Neutral

The Weekly Volume Report: FOMC Sparks Volume Surge

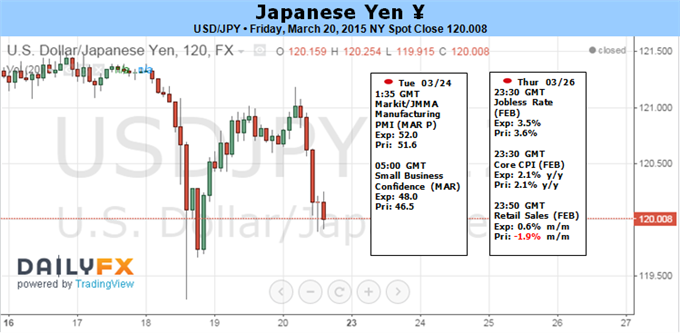

USD/JPY At Important Technical Juncture

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

In light of the market reaction to the Federal Open Market Committee’s (FOMC) March 18 meeting, the fundamental developments coming out of the world’s largest economy may continue to dictate the near-term price action for USD/JPY as Janet Yellen and Co. shows a greater willingness to retain the zero-interest rate policy (ZIRP) beyond mid-2015.

With that said, a slowdown in Japan’s Consumer Price Index (CPI) may have a limited impact on the dollar-yen especially as the Bank of Japan (BoJ) largely endorses a wait-and-see approach, while the U.S. data prints may foster increased volatility in the exchange rate as market participants continue to speculate on the Fed’s first rate hike. An uptick in the core U.S. CPI paired with an upward revision in the 4Q Gross Domestic Product (GDP) report may heighten the appeal of the greenback, but the disinflationary environment may become a growing concern for the central bank as the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for price growth, is expected to slow to 1.1% from 1.4% in the three-months through September.

The fresh forecasts coming out of the central bank suggests that FOMC will further delay its normalization cycle as the committee pushes out its interest rate dot-plot, and the Fed may sound more dovish heading into the second-half of the year amid the uncertainties surrounding the global economy. In turn, the dollar remains at risk of facing additional headwinds over the coming months, and the near-term pullback may ultimately turn into a larger correction should the U.S. data prints fail to meet market expectations.

As a result, the near-term topping process around the 122.00 handle may pave the way for a further decline in USD/JPY, and the pair may continue to give back the advance from earlier this year as the Relative Strength Index (RSI) fails to retain the bullish trend carried over from back in January. The downside break in the oscillator favors the approach to ‘sell bounces’ in the dollar-yen, but the pair may face choppy price action going into the key event risks as market participants continue to digest the latest developments coming out of the U.S.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx