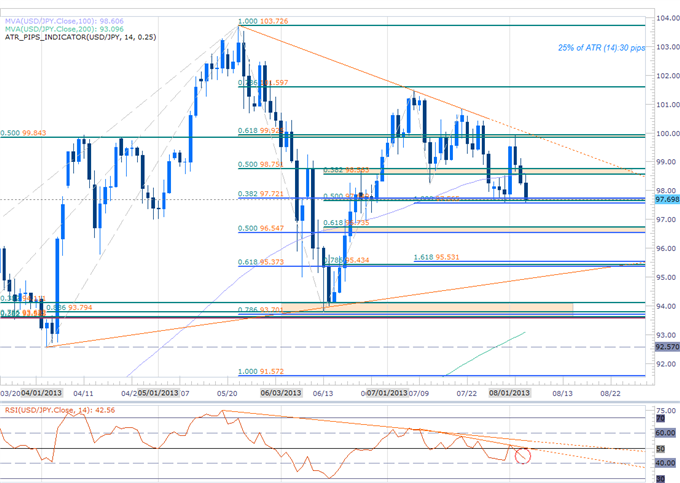

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

USDJPY now at Key Support at 97.56 – 97.65 – Scalp bias bullish above

Range represents

– 100% Fib Extension off the July High

– 50% Retrace from the June Low

– 38.2% Fib extension off the yearly high

Break below turns scalp bias bearish- Primary objective range 96.55 – 96.74.

Secondary support ranges 95.37 – 95.53

Longer-term bias bullish above 93.60 – 94.00 support range

Topside Breach above 99.85/90 triggers resumption broader up-trend

Daily RSI rejection of 60-threshold suggests near-term momentum remains heavy

Topside RSI Triggers to put conviction on long bias

Key Events Ahead:BoJ Rate Decision & U.S. weekly jobless claims on Thursday, U.S. Wholesale inventories on Friday

USDJPY Scalp Chart

Scalp Notes: Although the USDJPY is not a favorable scalp ahead of the BoJ interest rate decision, our near-term bias is now in line with our longer-term outlook and remains weighted to the topside above the 97.56 – 97.65 support range. Bottom line: a break below this key support structure risks a deeper correction in the pair with such a scenario eying subsequent support objectives. The intra-day RSI signature has been bearish since the start of the week with last night’s topside trigger offering conviction longs into resistance target 3 at 98.56. Look for the oscillator to reset with subsequent topside triggers above the 50-threshold putting longs into play so long as price remains above the 97.56 support level.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets

Timeframe

Level

Significance

Resistance Target 1

30min

97.84

88.6% Retracement

Resistance Target 2

30min

98.08

78.6% Retracement

Resistance Target 3

Daily / 30min

98.48 – 98.56

61.8% & 38.2% Retracements / 100 DMA

Bearish Invalidation

Daily / 30min

98.76

50% Retracements

Break Target 1

30min

99.10

Soft Res / Pivot / Weekly High (99.14)

Break Target 2

30min

99.35

61.8% Retracement

Break Target 3

30min

99.83 – 99.95

50, 61.8 & 78.6 Retraces / Aug High / TL Res

Bullish Invalidation

Daily / 30min

97.56- 97.72

38.2% & 100% Fib Exts / 50% Retracement

Break Target 1

30min

97.25

Soft Support / Pivot

Break Target 2

30min

97.00

Big Figure / Soft Support / Pivot

Break Target 3

Daily / 30min

96.56 – 96.73

61.8% Retrace / 1.272 & 50% Fib Exts

Break Target 4

30min

96.12

Soft Support / Pivot

Break Target 5

Daily / 30min

95.37 – 95.53

61.8% & 1.618% Exts / 78.6% Retrace

Break Target 6

Daily

Variable

Trendline Support Dating 4/2/2013

Average True Range

Daily

117

Profit Targets 27-30pips

Daily Scalp Setups in Play- USD, EUR & GBP Scalp Bias at Risk Ahead of FOMC, ECB, BoE, NFP

Reviews today’s Scalp Webinar for further insights and current trade setups

For updates on this scalp and more setups follow him on Twitter @MBForex

—Written by Michael Boutros, Currency Strategist with DailyFX

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael Tuesday, Wednesday and Thursday mornings for a Live Scalping Webinar on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Introduction to Scalping Strategies Webinar

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx