Key Points

- The US Dollar remained above the 1.0100 support against the Swiss Franc, and currently looking for further gains.

- There is a major bearish trend line with resistance at 1.0125 formed on the hourly chart of the USDCHF pair.

- Recently in the US, the Factory orders for Jan 2017 was released by the US Census Bureau.

- The result was in line with the forecast, as there was an increase of 1.2% in Jan 2017, compared with the previous month.

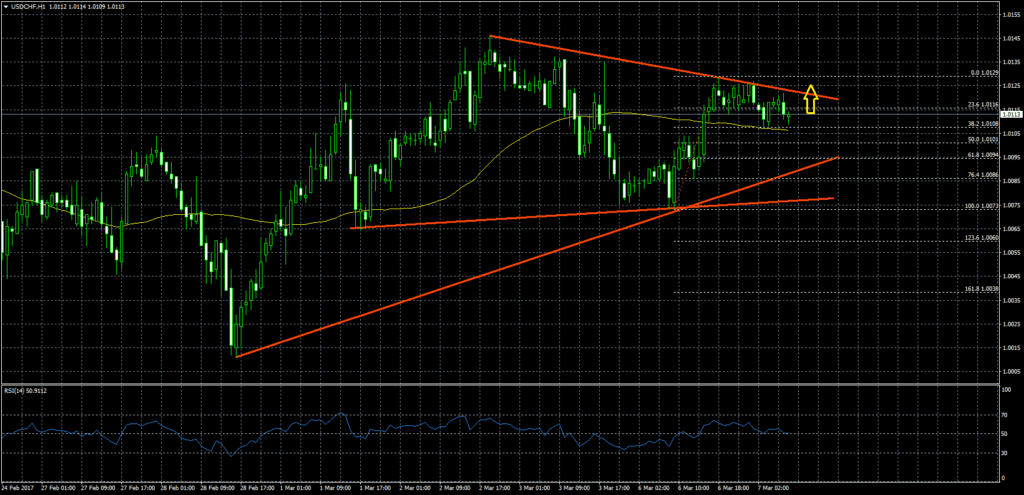

USDCHF Technical Analysis

The US Dollar managed to retain the bullish ground against the Swiss franc, and moved above the 21 hourly simple moving average at 1.0108. The USDCHF pair is currently trading higher, and attempting to break a major bearish trend line with resistance at 1.0125 on the hourly chart.

If there is a break above the trend line resistance, there can be a move towards the 1.0145 level, which also represents the previous swing high.

On the downside, there are many supports like the 21 hourly SMA at 1.0105, and a bullish trend line on the same chart at 1.0100.

US Factory Orders

Recently in the US, the Factory orders for Jan 2017 was released by the US Census Bureau. The market was expecting the total orders of durable and non-durable goods to rise by 1.2% in Jan 2017, compared with the previous month.

The outcome was in line with the forecast, as there was an increase of 1.2% in Jan 2017. The report added that “Excluding transportation, new orders decreased 0.2 percent. Excluding defense, new orders increased 1.5 percent. Transportation equipment, also up following two consecutive monthly decreases, drove the increase, $4.3 billion or 6.0 percent to $76.4 billion“.

Overall, the US Dollar may look to extend gains against the Swiss Franc, and could break the 1.0130 resistance in the near term.