Key Points

- US Dollar moved down against the Canadian Dollar recently, but found bids near 1.2900.

- Before the downside move, the USDCAD pair broke a bullish trend line on the hourly chart, which opened the doors for more losses.

- Today, the Canadian Consumer Price Index (CPI) will be released by the Statistics Canada, which may impact USDCAD.

- The forecast is slated for a rise of 1.6% in May 2016, compared with May 2015. <br><br>

Technical Analysis

The US Dollar traded positively against the Canadian Dollar until it found sellers near 1.3085. The USDCAD pair traded down, and also broke a bullish trend line on the hourly chart to trade as low as 1.2898.

The pair once closed below the 50 hourly simple moving average, but now back above it. There is a chance of it moving towards the 38.2% Fib retracement level of the last decline from the 1.3086 high to 1.2898 low where sellers may appear.

On the downside, the 1.2900 support level holds a lot of importance in the near term.

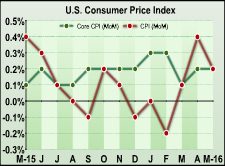

Canadian Consumer Price Index

Today, there is a major release in Canada, as the Consumer Price Index (CPI), which is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services will be released by the Statistics Canada.

The market is expecting the CPI to increase by 1.6% in May 2016, compared with May 2015. In terms of the monthly change, the Consumer Price Index (CPI) is forecasted to rise by 0.5% in May 2016, more than the last increase of 0.3%.

The result of the CPI report may impact the Canadian dollar and USDCAD pair in the near term. So, we need to trade accordingly in the short term.