The greenback is down for the third week in a row following nearly two months of steady gains. This drawdown could persist for now, owing to a few factors.

First, the only certainty that markets have at this point is that there will be more uncertainty. The Trump economic outlook is littered with lots of different ideas and possible policies so markets have been hard-pressed to focus on one narrative. This has seen old correlations breakdown, leaving markets a bit baffled about direction.

Second, it is also likely that market participants have conflated Trump economic policy and a global pickup in data surprises. Global data surprises are running near cyclical highs, suggesting the pickup in growth expectations is not just a US story.

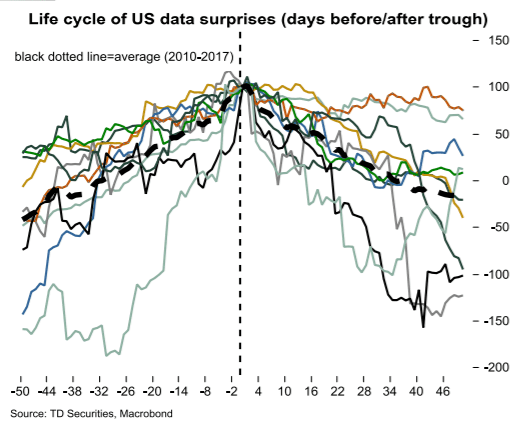

This leads to the third point. The USD looks vulnerable on a pullback in data surprises, especially given the mean-reverting nature of the index. The first chart shows the typical cycle of US data surprises that lasts around 50 days from trough to peak. The recent low was set on 10/20/2016. This means the index is running ahead of the cycle average and could reverse throughout Q1. This could keep the USD vulnerable to more downside over the coming week, although we expect dips to be short and shallow.

Copyright © 2017 TD Securities, eFXnews™Original Article