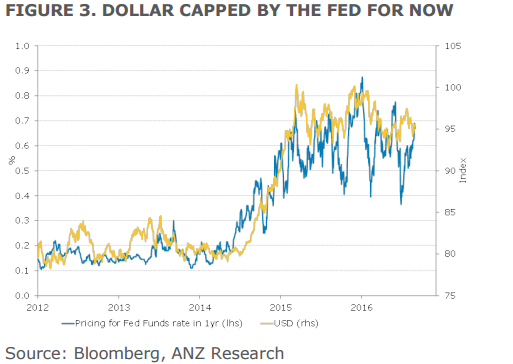

The Fed has played a big role in driving the trend in the USD in this cycle. However, this seems to be coming to an end, at least temporarily.

Figure 3 highlights how the recent stalling in the USD has been partially related to how the Fed is being priced. One can see that after the initial adjustment at the beginning of the hiking cycle in 2014, the USD was bounded by the unwillingness of the market to aggressively price a near-term path higher for the fed funds rate despite forward guidance provided in the dot plot. This has proved to be a prudent strategy as the dot plot has been consistently revised lower, and it’s hard to see why it should change in the near term.

As such, while a hike in 2016 will likely place a floor under the USD, continued conservative pricing of the cycle into 2017 should ensure that it will be difficult for the USD to break to a fresh high.

Copyright © 2016 ANZ, eFXnews™Original Article