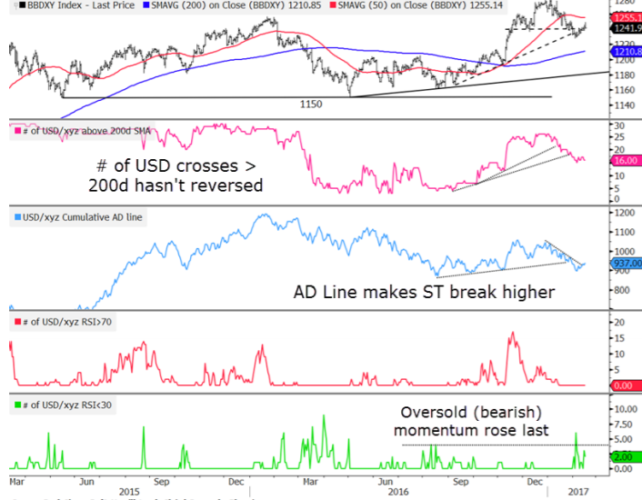

USD struggling to technically follow through:

The BBDXY neckline resistance area from 1240-1245 and the old trend line (dashed) has contained USD strength. Seeing the market fade USD strength after retail sales and CPI on Wednesday is not a good short-term sign in our view.

We’d like to see the number of USD crosses above the 200d moving average increase to 20 to indicate our 2017 stronger USD view will resume. (Chart 1)

A breakout through neckline resistance and stronger breadth could end the monthly chart’s price/momentum bearish divergences that support a Q1 correction.

EUR/USD retraces 61.8% of YTD rally, and starts recovery:

The US dollar strength after Wednesday’s data was quickly faded against the euro when spot EUR/USD reached the 61.8% retracement level of the YTD trend.

Spot has closed below the 50d SMA, and that is bearish; however, Wednesday’s oversold recovery, “hammer” like candle, and a TD Setup 9 suggest a bounce first.

Support: 1.0455, 1.0340. Resistance: 1.0720, 1.08.

Copyright © 2017 BofAML, eFXnews™Original Article