Sentiment at the close of the US session yesterday was sour as growth concerns re-surfaced after some weaker PMI numbers out of China and the UK yesterday. Overnight data out of New Zealand showed that unemployment rate rose to 5.7% for the first quarter.

Sentiment in Asia remained predominantly negative this morning with much of the major equity indices pointing lower at the time of writing.

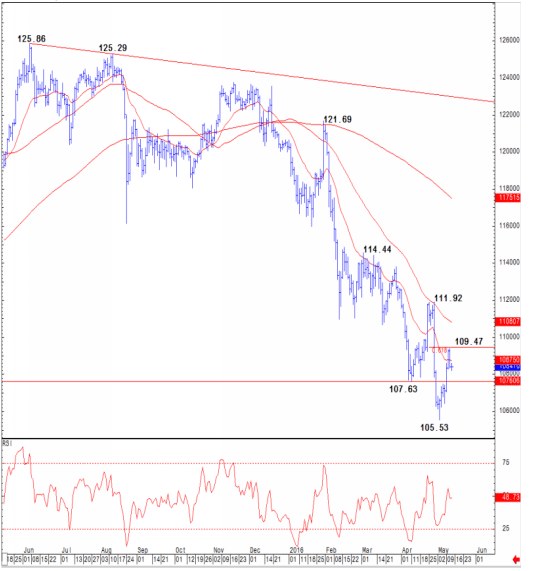

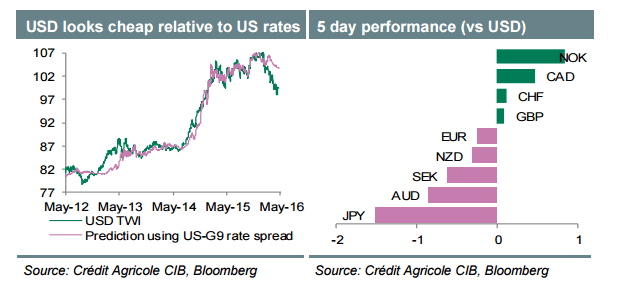

The USD managed to garner back some of the lost strength after 6 consecutive day’s of losses, while the Yen’s gains seemingly paused – but the Yen appeared on the defensive as the USDJPY held well below 108 levels.

EURUSD is pulling back after peaking to highs of 1.1616 yesterday, highs which we had not seen since August 2015.

Yesterday the AUDUSD suffered a 2.36% setback as the Aussie sold off on the back of the rate cut delivered by the RBA early into yesterday’s session. The RBA cut the policy rate from 2% to 1.75% to counter the threat of deflation.

Later today during the european session we have EZ services and composite PMIs, and Retail Sales. In the afternoon the US is expected to have created 195k jobs for the month of April as we await the ADP emplyment change. The ADP is widely considered the precursor of Friday’s NonFarm Payrolls data. From the US Session as well we await the Factory Orders and Duarble Goods Orders.