USD rally to fizzle out. The USD has rallied over the past three weeks, but US economic indicators have undershot market expectations for nine weeks. Our US economics team projects the US economy to slow down from its current 3.1% expansion in 3Q to 1.5% in 4Q. August retail sales data have disappointed, and with the US election campaign now heating up, uncertainties may keep the economy on the back foot. A USD rally may need risk to sell off further from here

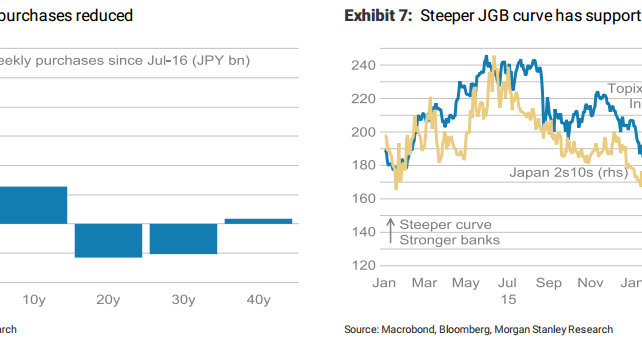

The transition to JPY bearishness. Steepening the JPY yield curve is a necessary, but not sufficient condition to weaken the JPY. Specifically, the steeper curve also requires higher inflation expectations. Here, fiscal authorities have to step up, not necessarily by launching another spending package, but by moving toward long-term funding. Aggressive steps toward long-term funding may help Japan fiscal multipliers to recover by breaking the link between rising sovereign debt and precautionary private sector savings. The BoJ's yield curve operation has put the ball in the MOF's court. Should the MOF decide to play, the JPY may develop surprising weakness.

Trading FX if curve steepens with higher inflation expectations. The first and most important implication of a steeper yield curve driven by higher inflation expectations is that we think the JPY would weaken. Markets have done a full 180 from where they were late last year. Back then, market participants hoped the JPY weakening trend that had lasted three years would continue. However, matters changed when Japan's yield curve became flatter, with long-term bond yields falling into negative territory. The signal to markets was clear: from here, relative real yields can only fall should Japan be able to boost inflation. The JPY trade became tightly connected to Japan's inflation outlook, creating a negative feedback loop with falling inflation feeding into a stronger JPY and the stronger JPY dampening import prices leading toward an even stronger JPY. It is about breaking the loop. Should Japan's authorities recognise these challenges, then it would be time for us to lean against the consensus once again.

In line with this view, Morgan Stanley maintains a long EUR/JPY position targeting a move to 120 with a stop at 112.30.

*This trade is recorded and tracked in eFXplus Orders.

Copyright © 2016 Morgan Stanley, eFXnewsOriginal Article