Despite a still cautious FOMC tone this week, which left open but suggests a high hurdle for a July hike, focus in the coming week will be squarely on the UK Referendum. We have highlighted our views on the impact of the UK Referendum on GBP and EUR with our base case that the GBP trade-weighted index moves 10% higher/lower on a Remain/Leave scenario. Our Japanese FX strategists view that USD/JPY could fall below 100 towards 95 on a Leave scenario.

On a Leave vote, we would expect the dollar to broadly outperform against G10 with the exception of the Yen and Swiss franc. The significant 15% decline our equity strategists see in UK equities would likely see a more-than 10% decline in the S&P 500 (based on historical betas) creating a significant global risk off event. This would lead to significant safe haven demand of the USD (alongside the JPY and CHF), in our view. While such a scenario would likely keep the Fed at bay in 2016, the flight-to-quality flows would dominate any shift in Fed policy expectations.

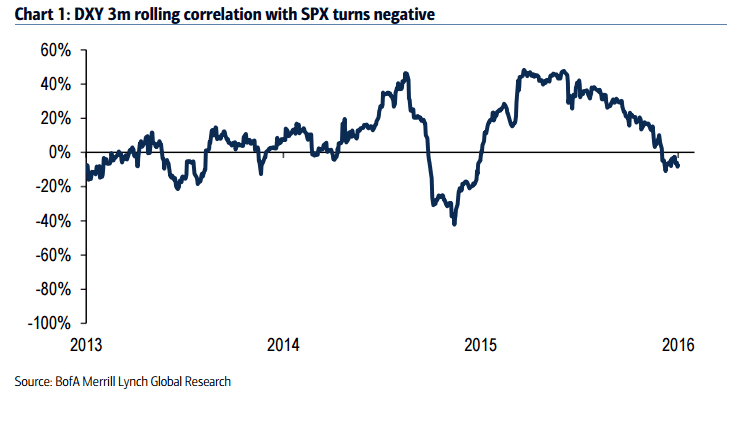

Two facts highlight this point. First, the DXY’s 3m rolling correlation with equities has recently turned negative having been positively correlated since mid-2015. Secondly, as we have highlighted in the past, when the market isn’t pricing the next Fed hike for more than 12 months, the USD performs well in risk-off scenarios. Following this week’s FOMC meeting, the market is now not pricing the next full hike until 2018, according to the OIS curve. As a result, any Brexit-driven risk off is likely to lead to a USD-positive flattening of the yield curve. Policy expectations may not be a factor in the initial response, but to the extent that a Leave vote pushes the BOE or the ECB to ease policy through lower rates and additional balance sheet expansion, the USD-positive signal could be sustained.

In a Remain scenario, we would expect the dollar to underperform, though to a lesser extent than it would outperform on a Leave vote. Assuming US data holds up as the Fed expects, the passage of this risk event would reduce Fed concern about poor global financial conditions, leaving open the potential for near-term hikes. With the next full hike not priced until 2018, we would likely see a USD-positive re-pricing of the OIS curve limiting its potential downside.

Copyright © 2016 BofAML, eFXnews™Original Article