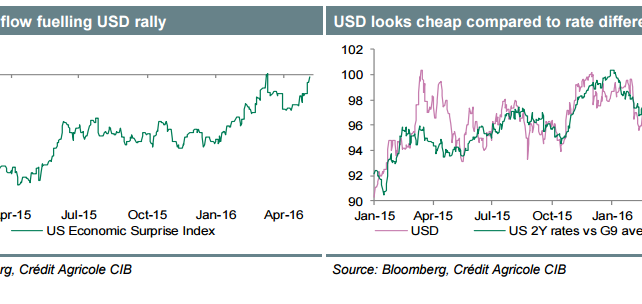

Fed rate expectations were little changed over the past week but they maintained their elevated levels. Global risk sentiment improved further on the back of more upbeat US data, with both lending support to the USD rally.

Data flow turns heavy this week with PCE and PMIs, among others, culminating in the May jobs report. Importantly, core PCE inflation is expected to stabilise at 1.6% YoY. In addition, the May jobs report is likely to be positive on balance; while non-farm payrolls may come in on the weaker side due to the Verizon strike, the unemployment rate is expected to edge lower and average hourly earnings should maintain a solid pace.

Overall, incoming data this week should build a case for Fed rate hikes to continue this summer. Although short-term rate expectations are unlikely to rise, additional positive data flow in the US should prove an important driver in keeping USD supported.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article