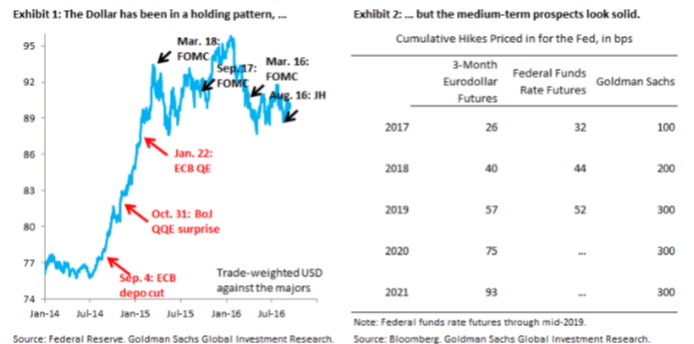

The USD is struggling to preserve the gains seen since last Wednesday. Yesterday we saw the buck close negatively after the latest Fed policy maker, Lael Brainard, voiced his comments and warned against the risks of exiting support for the economy too quickly.

His dovish comments impinged on September rate hike expectations. The situation is getting rather volatile as the Fed is now left with only two options if it wants to preserve its credibility and deliver more rises by end 2016 – September or December. Fed Speakers haven’t been making its easier for investors looking for signs, as there have been varied comments and the USD has see sawed accordingly.

Earlier in today’s session we saw that Chinese Industrial Production, and also Retail Sales for the month of August performed well and were either in line or in excess of market expectations.

USDJPY, is attempting to reclaim 102 levels and is currently trading at 101.90. Earlier lows for the currency pair have been at 101.42, but as long as these levels hold TraderTip sees the possibility of a move higher to 102.25:102.50 levels later today.

EURUSD looks practically flat at around 1.1235 at the time of writing. It is likely that price action will find some resistance at the daily resistance levels of 1.1265/1.1295.

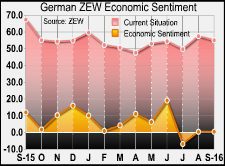

The high impact data from today’s economic docket include UK CPI that is expected to tick higher, and German and EZ Zew survey.