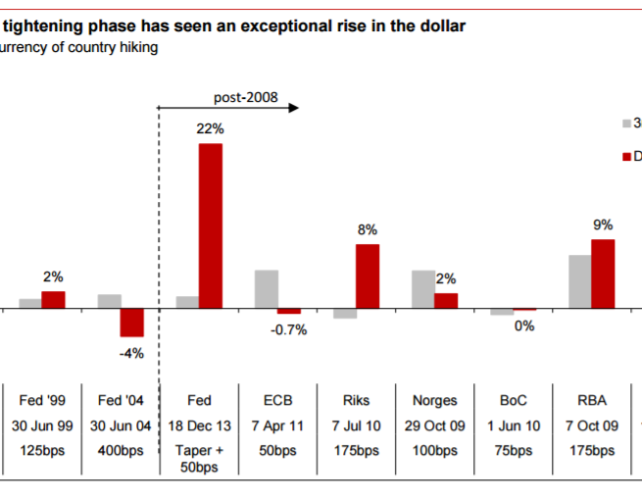

Today’s siren song in currency markets is of upcoming Fed hikes, with many investors being lured into bullish dollar positions.

Admittedly, the dollar has bounced on yesterday’s hawkish comments from Fed Chair Yellen and today’s strong data, but shortterm bounces do not always translate into long-term trends. Indeed, Ms Yellen’s upbeat speech on 18 January saw a similar rally in the dollar only for it to falter some days later

……At the same time, this also implies that other central banks pursuing non-conventional monetary policy, such as the ECB and BOJ, have very negative implied policy rates. But if they were to exit their policies then they should see an equivalent tightening and hence currency appreciation. This will likely be the bigger story for 2017 – US economic strength will help boost global growth and tilt the risks for the ECB and BOJ to exit their ultra-easy policies. Already the BOJ has seemingly ratcheted up its 0% 10yr target to 0.1% and inflation is picking up sharply in the euro area, which should increase the likelihood of the ECB tapering after the French elections.

We therefore favour maintaining a bearish dollar stance and would look to sell any rallies in the currency.

Copyright © 2017 Nomura, eFXnews™Original Article