US Dollar Traders Weigh Taper, ECB and BoJ Stimulus Plans

Fundamental Forecast for US Dollar: Bullish

As the market debates whether the Taper is still on, the ECB and BoJ are expected to be actively pursuing stimulus

Janet Yellen’s testimony has provoked doves, but data will help determine whether the Fed is still in line for a QE cut

Will the Fed’s next Chairperson – Yellen leads – defer the Taper? Trade the US Dollar’s via our Mirror Trader currency basket

We are in the midst of another stimulus war, and this time the dollar may be one of the better positioned combatants. As the market debates the timing of the Fed’s eventual downshift in QE purchases, two of the central bank’s biggest counterparts (ECB and BoJ) are moving to increase their accommodation. That is a fundamental juxtaposition that offers the backdrop for volatility around event risk that taps into stimulus speculation, but it also presents the framework for genuine trend development as well. Unlike the focus on risk trends which have struggled to gain traction and require a constant stream of fundamental encouragement, relative monetary policy has proven more than capable of generating and maintaining market movement.

Much of the potential for the dollar through the immediate future is actually derived from its international counterparts. In the ECB’s (European Central Bank) surprise rate cut two weeks ago, the world’s second largest central bank put into action a dormant fundamental concern. That move is unlikely to confer much benefit to either the economy or financial system; and in a time of QE programs, the market naturally expects the group to follow up with a replacement for the previous LTRO programs which were used to fund banks and are currently being wound down. With a sharp drop in inflation, ongoing austerity drive, persistent recessions for some member economies and a cooler global outlook; there is more than enough reason in this dovish era to ease.

Using monetary stimulus to support economic health has become common place; and when a major player like the ECB changes its line, it causes speculative ripples across the world. Interest in the BoJ’s (Bank of Japan) expected stimulus upgrade has also been restored. The market has expected an upgrade of the Japan central bank’s asset purchase program for some time. Yet, it seems the ECB’s about face has made the world more sensitive to policy efforts in general. With USDJPY climbing above 100, we are met with fundamental and technical déjà vu. A year ago, the pair – and all yen crosses – made an incredible run higher in the lead up to what would be the largest relative stimulus program seen to date. The actual implementation in April generated a modest extension. It was the build up that captured speculators’ attention. We are in the same point in that same cycle today with the BoJ seen upgrading next April.

Of course, a competitive stimulus field is only beneficial to the dollar so long as the US is expected to keep its course towards the eventual Taper – or at the very least maintain status quo. This past week, the probable next Fed Chairperson – Janet Yellen – put on a dovish face in her testimony at the confirmation hearing. She stated, “a strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy…” That certainly tempers expectations of an imminent reduction in QE3, but it is far cry from writing off the option altogether. Data from recent months was solid, the policy officials have worked hard to separate Taper from rate hikes, and the last Fed statement actually upgraded its growth assessment while dropping financial concerns.

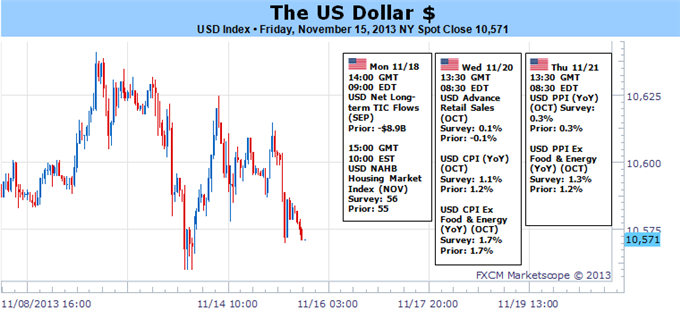

The market will remain as sensitive as ever to changes in probability for Fed policy. In the week ahead, a number of Fed officials are scheduled to speak on the economy and monetary policy – though there is notably no Yellen on the docket. Wednesday will bring the minutes from the October 29-30 FOMC meeting (19:00 GMT) with important details to surmise the balance of opinion in the group. For data, the coverage is wide. Retail sales, manufacturing activity and housing data (price and sales) will produce a bigger picture for economic activity. Yet, the monetary policy bend will place a particular emphases on the October CPI data due Wednesday (13:30 GMT). The headline, annual figure is expected to drop to 1.0 percent – a four year low. And, we saw what happened to the Euro after the Eurozone price gauge slid to multi-year lows just a few weeks ago.

And, while relative monetary policy can be a fundamental driver all its own; when the tides grow, there is often a consequential risk trend reaction. A uniform, global stimulus swell can encourage yield reach and minimize fears of volatility. Alternatively, a disproportionate interest in the Fed could still prove the trigger for global risk aversion should the masses come to believe the Taper is soon at hand. – JK

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx