US Dollar Risks Breakdown Before the Fed’s Taper Decision

Fundamental Forecast for US Dollar: Neutral

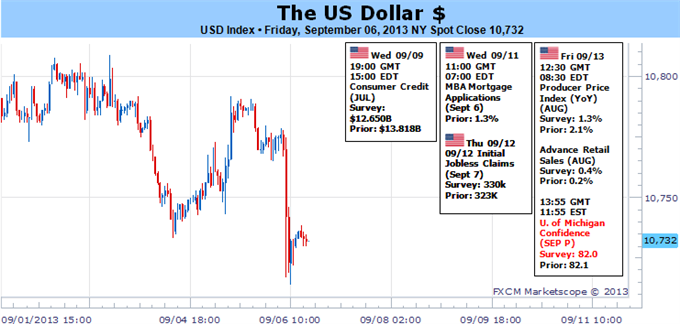

We are heading into a new week following a failed NFPs release to stoke fear and uncertainty of the FOMC dead ahead

A lack of a clear risk bearing doesn’t necessarily save the dollar, beware of curbed Taper premium

Trade the US Dollar’s moves via our currency baskets on Mirror Trader

Trading conditions are growing dangerous – not because a particular currency or asset classes is threatening an unfavorable turn; but rather because there are alluring technical setups that are likely to fall apart almost immediately after they trigger. That is particularly true for many of the dollar-based pairings. The greenback’s greatest hope for a strong return to bull trend moving forward is to find the market scrambling for safety and finding it in the renowned reserve currency. Yet, even the highly contagious sense of fear will find it difficult to gain traction this week given the pivotal September Fed rate decision – and possibly the Taper – is due the week after.

The Federal Open Market Committee’s next policy meeting – also sporting the updated forecasts and Chairman Bernanke press conference – is scheduled for Wednesday September 18. Anticipation of this particular event has driven price action in many benchmark assets over the past months; and as such, the singular focus can distract from other developments that may arise in the meantime. While the forthcoming event risk is being debated for all its nuances, its ultimate influence over the market comes through the elemental assessment of risk trends. Investors are concerned what will happen to the high-flying, low-yield markets if the world’s largest central bank is planning to pullback on its massive backstop for speculators. The likelihood that market participants build up exposure to Taper-sensitive positions ahead of such a critical event is low. And, that is the kind of trading backdrop that we need to remember for this week.

Considering the current bearings of the dollar, equities, Treasuries and debt markets; there are certain probability bounds to expect during the countdown. With the S&P 500 closing this past week only 3.2 percent from its record set a month earlier and the consensus shifting to a reduction in central bank support this month, it would be particularly difficult to rouse the masses to a strong bull trend. In fact, given the positioning on cheap borrowed funds, that buffer likely exists for the broader financial market. We have see the evidence of this restraint in the tepid response to strong economic data like the ISM manufacturing and service sector reports as well as the ‘disappointing’ figures for the August NFPs.

For some, the 169,000-net increase in payrolls (missing the forecast of 180,000) is evidence of a disappointing outcome that could sideline the Taper. Alternatively, the more economically-oriented see the weak showing in labor dynamics like participation, full versus part-time jobs and even dubious accounting as reason to defer. Yet, the positive payroll doesn’t matter as much to the Fed as the downtick in the unemployment rate (to 7.3 percent); and imperfect data or not, the Fed makes decisions on the BLS statistics. It is important to recognize the consensus for a September Taper. We have seen both doves and hawks from the central bank support the June timeline – which heavily insinuated a Taper this month. US President Barack Obama commented to his international counterparts that the stimulus withdrawal would proceed soon. Primary dealers – those institutions that have to by Treasuries and dictate the ‘market consensus’ for the Fed – have established the same time frame. And, most importantly, the markets have penciled in September as evidenced by yields.

In fact, we have seen considerable adjustment to peak-stimulus already over the past months from US Treasuries, emerging market capital flows, high-yield assets, carry trade and other yield sensitive assets. That leaves us with an unusual situation with the S&P 500. Why has this benchmark for risk appetite not corrected more enthusiastically? Are investors behind its performance holding out to the last minute, or perhaps the wind down from the Fed doesn’t unnerve this particular financial asset. If the latter proves true, it could prove a serious blow to the greenback who has benefit capital flight and now needs an appetite for safety to continue.

With the 10-year Treasury yield having already climbed 118 percent from its record low last year, belief that a wave of risk aversion will not materialize could undermine ‘Taper premium’. Given the adjustments in expectation of the event in the dollar, yields and elsewhere; those big moves could be correct – possibly even before the actual policy gathering. That wouldn’t necessarily feed a traditional risk appetite run (resulting in developments like a strong equity rally), but it could send the USDollar and 10-year yield posting meaningful retracements. Dollar traders must recognize the Taper, expectations for the Taper and risk trends. – JK

Sign up for John’s email distribution list, here.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx