UK house price inflation eased in August as slower wage growth in relation to inflation intensify pressure on household finances amid weak economic growth, a private survey showed Tuesday.

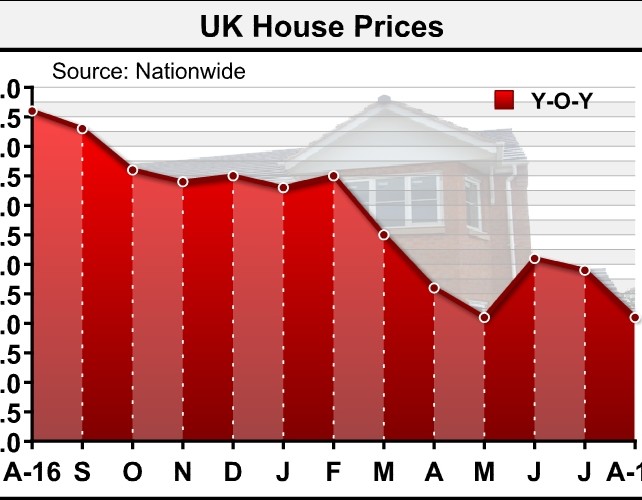

House prices increased 2.1 percent year-on-year in August, slower than the 2.9 percent growth seen in July, data published by the Nationwide Building Society showed Tuesday.

This was also weaker than the expected growth of 2.5 percent. A similar pace of slower expansion was last seen in May.

The slowdown in house price growth to the 2-3 percent range in recent months from the 4-5 percent prevailing in 2016 is consistent with signs of cooling in the housing market and the wider economy, Robert Gardner, Nationwide's chief economist, said.

While employment growth remained robust, household budgets are under pressure, Gardner said. This suggests that the housing market activity will remain subdued.

Month-on-month, house prices fell 0.1 percent in August, reversing a 0.2 percent rise in July. Prices were forecast to remain flat in August.

Stamp duty revenues reached an all-time high in recent quarters, the Nationwide economist said.

This may appear surprising, given that the number of residential property transactions in the year to June 2017 was 30 percent below that recorded in the same period of 2007, Gardner noted.

As the stock of homes on estate agents' books remains close to 30-year lows and the number of new homes coming onto the market remains subdued, Nationwide continues to expect house prices to rise around 2 percent over 2017 as a whole.

In any event, until the gap between house prices and incomes begins to close more meaningfully, Ed Stansfield, Capital Economics' economist, said mortgage demand will be constrained.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News