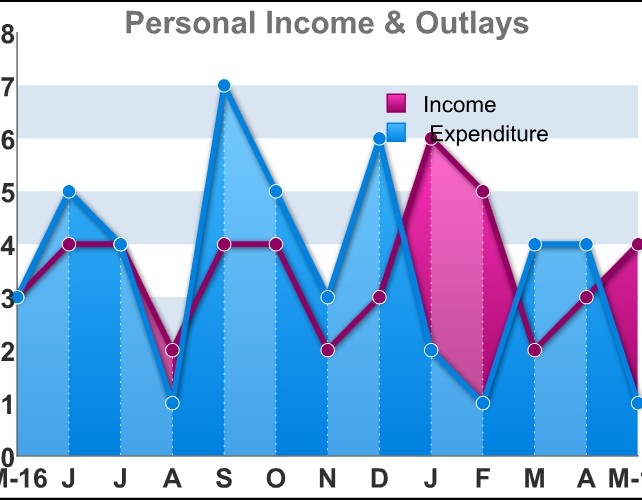

Personal income in the U.S. rose by slightly more than anticipated in the month of May, according to a report released by the Commerce Department on Friday, while personal spending inched up in line with estimates.

The Commerce Department said personal income climbed by 0.4 percent in May after rising by a downwardly revised 0.3 percent in April.

Economists had expected income to rise by 0.3 percent compared to the 0.4 percent increase originally reported for the previous month.

Disposable personal income, or personal income less personal current taxes, increased by 0.5 percent in May after rising by 0.3 percent in April.

Meanwhile, the report said personal spending inched up by 0.1 percent in May after climbing by 0.4 percent in April. The uptick in spending matched economist estimates.

Real spending, which is adjusted to remove price changes, also crept up by 0.1 percent in May after edging up by 0.2 percent in the previous month.

With income rising more than spending, personal saving as a percentage of disposable personal income, jumped to 5.5 percent in May from 5.1 percent in April.

A reading on inflation said to be preferred by the Federal Reserve showed that core consumer prices were up 1.4 percent year-over-year in May compared to the 1.5 percent increase seen in April.

"Although the real economy is doing well, Fed officials are concerned that isn't translating into stronger inflationary pressures," said Paul Ashworth, Chief U.S. Economist at Capital Economics.

He added, "Nevertheless, with the unemployment rate plummeting even further below its long-run sustainable level, we expect the Fed to push ahead with additional interest rate hikes."

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.