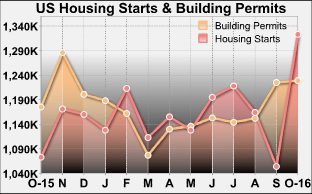

After reporting a steep drop in new residential construction in the previous month, the Commerce Department released a report on Thursday showing that U.S. housing starts rebounded by much more than expected in the month of October.

The Commerce Department said housing starts surged up by 25.5 percent to an annual rate of 1.323 million in October after tumbling by 9.5 percent to a revised 1.054 million in September.

Economists had expected housing starts to jump by 11.6 percent to a rate of 1.168 million from the 1.047 million originally reported for the previous month.

With the much bigger than expected increase, housing starts rose to their highest level since reaching a rate of 1.330 million in August of 2007.

The rebound was partly due to a substantial increase in multi-family starts, which soared by 68.8 percent to a rate of 454,000. Single-family starts also shot up by 10.7 percent to a rate of 869,000.

New residential construction increased in all four regions of the country, with housing starts in the Northeast and Midwest showing particularly big jumps of 44.8 percent and 44.1 percent, respectively.

The report also said building permits, an indicator of future housing demand, edged up by 0.3 percent to a rate of 1.229 million in October from 1.225 million in September.

The modest increase came as a surprise to economists, who had expected building permits to drop by 2.9 percent to a rate of 1.190 million.

Single-family permits climbed by 2.7 percent to a rate of 762,000, although the increase was partly by a 3.3 percent drop in multi-family permits to a rate of 467,000.

On Wednesday, a report from the National Association of Home Builders said homebuilder confidence held steady in November, with most members responding before the elections.

The report said the NAHB/Wells Fargo Housing Market Index came in at 63 in November, unchanged from October. The unchanged reading matched economist estimates.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Forex News