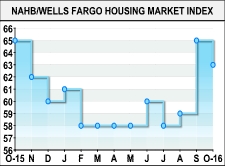

After reporting a sharp jump in U.S. homebuilder confidence in the previous month, the National Association of Home Builders released a report on Tuesday showing that homebuilder confidence has pulled back in the month of October.

The report said the NAHB/Wells Fargo Housing Market Index dipped to 63 in October after jumping to an eleven-month high of 65 in September. The drop by the index matched economist estimates.

"Even with this month's drop, builder confidence stands at its second-highest level in 2016, a sign that the housing recovery continues to make solid progress," said NAHB Chairman Ed Brady.

He added, "However, builders in many markets continue to express concerns about shortages of lots and labor."

The pullback by the housing market index reflected decreases by two of the three components that make up the index.

The component gauging current sales conditions slipped to 69 in October from 71 in September, and the index charting buyer traffic edged down to 46 from 47.

On the other hand, the index measuring sales expectations in the next six months inched up to 72 in October from 71 in September, reaching its highest level in a year.

"Mortgage rates remain low and the HMI index measuring future sales expectations has been over 70 for the past two months," said NAHB Chief Economist Robert Dietz. "These factors will sustain continued growth in the single-family market in the months ahead."

Wednesday morning, the Commerce Department is scheduled to release a separate report on new residential construction in the month of September.

Housing starts are expected to climb to an annual rate of 1.180 million in September after tumbling to a rate of 1.142 million in August.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.