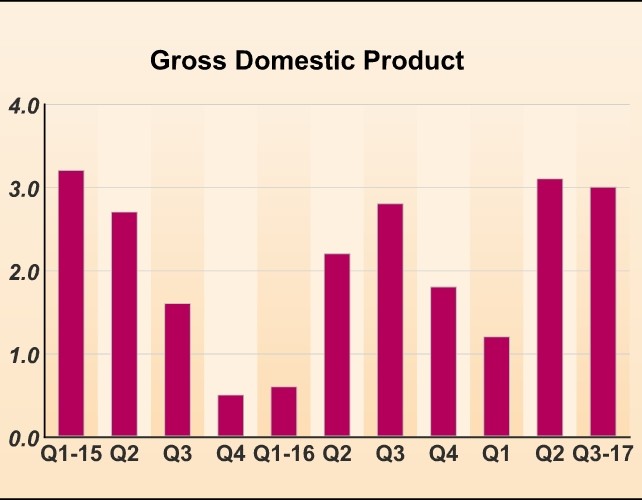

Economic growth in the U.S. slowed modestly in the third quarter, according to a report released by the Commerce Department on Friday, although the pace of growth still exceeded economist estimates.

The report said real gross domestic product jumped by 3.0 percent in third quarter after surging up by 3.1 percent in the second quarter. Economists had expected GDP to increase by 2.5 percent.

The Commerce Department said the stronger than expected GDP growth reflected positive contributions from consumer spending, private inventory investment, non-residential fixed investment, exports, and federal government spending.

The increases were partly offset by negative contributions from residential fixed investment and state and local government spending.

The modest slowdown in the pace of growth primarily reflected decelerations in consumer spending, non-residential fixed investment, and exports that were partly offset by an acceleration in private inventory investment and a downturn in imports.

"GDP growth for 2017 as a whole is currently tracking at around 2.1% and, assuming we see a modest fiscal stimulus in early 2018, we expect GDP growth to accelerate to 2.5% next year, even after allowing for a more aggressive pace of monetary tightening," said Paul Ashworth, chief U.S. economist at Capital Economics.

"As the stimulus wears off and the cumulative monetary tightening begins to bite, however, 2019 could be a very different story," he added. "We expect GDP growth to slow to only 1.5%."

A reading on core consumer prices, which exclude food and energy prices, showed that the pace of price growth accelerated to 1.3 percent in the third quarter from 0.9 percent in the second quarter.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.