The US payroll’s surprise is expected to extend the macro ‘peace’ by delaying a Fed tightening and placing less immediate pressure on the Rmb ‘peg’.

We expect a similar backdrop to the melt up in global risk appetite we saw in February – April, but with much less attractive valuations. For many macro players this will continue to feel dissatisfying. The positive risk melt up, is mostly about not feeling as negative, rather than feeling positive, which does not lead to high conviction trading decisions.

From a currency perspective, there is no point in fighting the shift in tone too early.

The DXY will be a good next indication of how far the USD downdraft versus the majors has to run, as a break of 93.65 would signal another run at the 91.91 low.

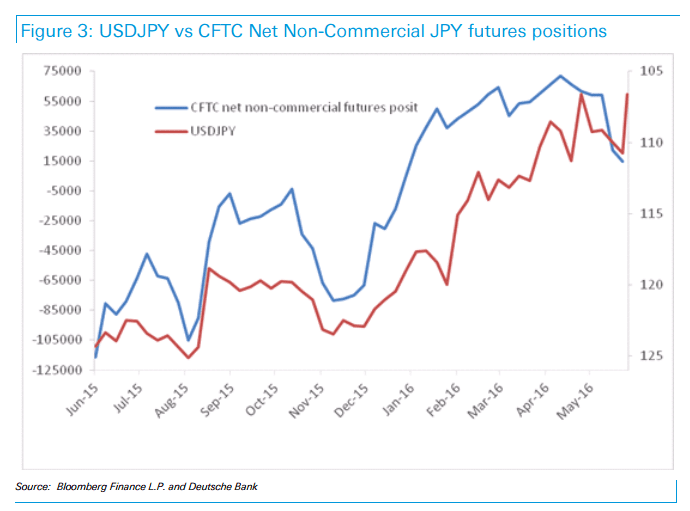

USD/JPY is on track to retest and break the 105.55 cycle low soon. Positioning data would suggest that specs are not massively long JPY, or can't add to longs from here. In any event, local hedging will dominate the yen's trend. All of this plays to a further run in key JPY cross pairs, notably the EUR and GBP. Of the Europeans, stronger Swedish data reinforces a view that SEK is the preferred proxy EUR long.

Valuations will figure into Central Bank signaling, constraining Kiwi most (near 0.70), then Aussie (0.74), and to a lesser degree CAD (1.2770, and if that breaks 1.25).

Copyright © 2016 DB, eFXnews™Original Article