We will be reviewing our AUD and NZD forecasts post the BoJ and FOMC meetings on 21 September along with our other G10 FX forecasts, and the risk is increasingly that we switch to forecasting upwards rather than downwards trends.

For the AUD and NZD to depreciate significantly from current levels, either the FOMC has to become more aggressive in its rate normalisation cycle or investor concerns about global growth need to build into a risk-off event.

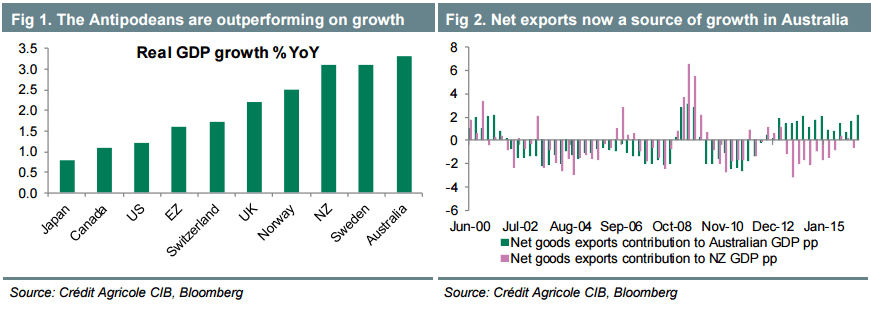

The Antipodean economies are star performers in the G10, and so AUD and NZD have strong yield appeal. The threat of RBA and RBNZ rate cuts is only limiting AUD and NZD upside, in our view.

The NZD’s greater yield appeal and sensitivity to capital flows relative to the AUD will keep AUD/NZD under downward pressure. The threat of RBNZ intervention to limit NZD strength has therefore grown as parity looms.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article